Exploring the Holdings of the Top 10 Superinvestors

Investing intelligently should be the goal of anyone looking to build their net worth and financial security for the future, so how do some of the richest people in the world approach their investment opportunities? We’ve taken a look at the top ten ‘superinvestors’ to see what their investment portfolios and strategies are like. We’ll first take a look at their individual portfolio values – who’s at the top of the food chain? Then, we’ll go a little deeper to see what specific holdings each investor is diversifying with.

To round the analysis out, let’s investigate which industries and sectors take up the most space in our top ten’s portfolios, the most significant buys and sells from last year’s fourth quarter, and their investment strategies in regards to market cap. Read on to find out how you can become the next superinvestor!

Best of the Best

By a massive margin, the richest portfolio belongs to Warren Buffet, who is also the CEO of Berkshire Hathaway. The company owns a multitude of businesses in insurance, transportation, energy, manufacturing, and retail. Buffett’s portfolio has netted him close to $200 billion more than the next company, Dodge & Cox, who specialize in mutual fund investments.

The next four portfolios are all worth above $30 billion, with Chase Coleman, founder of Tiger Global Management, an investment firm focused on the internet, software, consumer, and financial technology industries. A little further down the list are two very recognizable names, being Bill and Melinda Gates – their trust foundation has a portfolio value just north of $22 billion. The foundation is committed to tackling inequalities around the world, including helping fight against poverty and disease.

An In-Depth Look

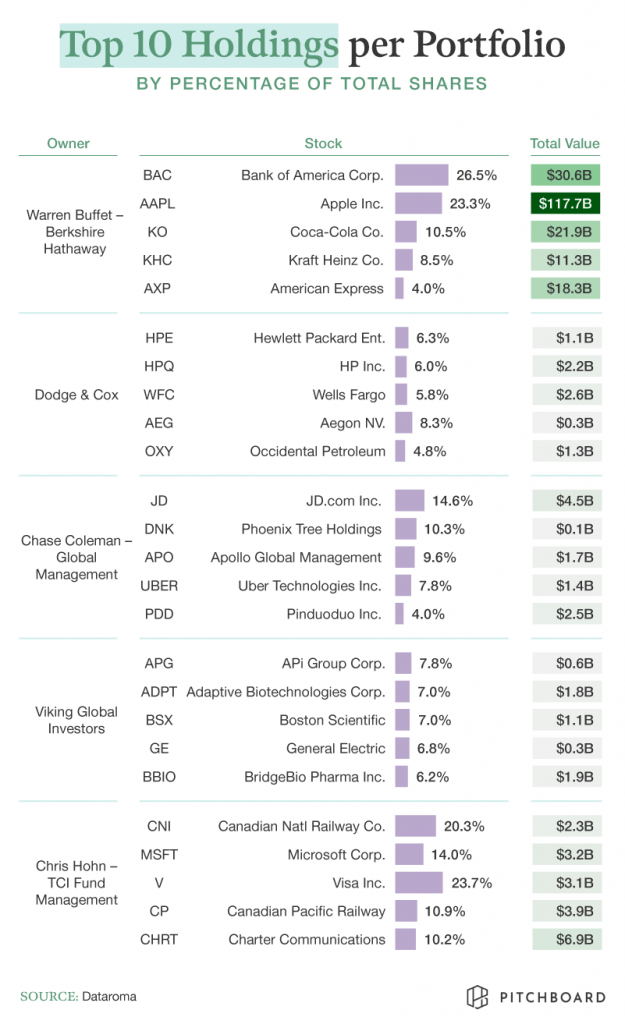

What exactly are investors holding in their portfolios? Let’s first take a look at the top five moneymakers for Warren Buffett. Over a quarter of his portfolio is dedicated to Bank of America shares at a value just north of $30 billion. Fascinatingly, even though he owns fewer Apple shares, their worth is nearly quadruple that of his Bank of America investment – the tech company accounts for nearly 44% of his entire portfolio value. Rounding out his top five, Buffet has significant holdings in mega corporations including Coca-Cola, Kraft Heinz, and American Express. As previously mentioned, Buffett’s portfolio value is in a league of its own.

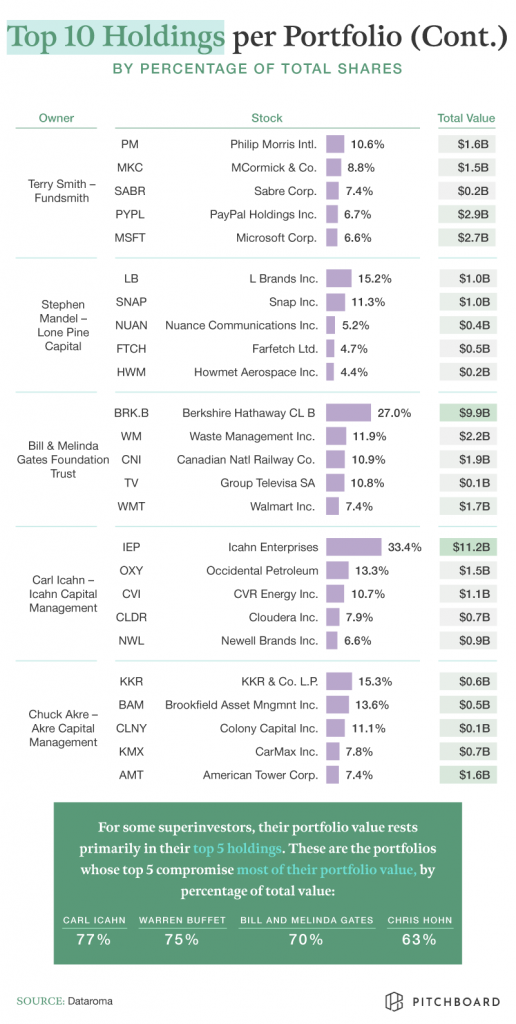

There are a couple interesting portfolio holdings above that worth pointing out – for example, 27% of The Bill & Melinda Gates Foundation Trust holdings are in Berkshire Hathaway, accounting for $9.8 billion of their portfolio. Also, over a third of Carl Icahn’s holdings are invested in his own enterprise, pulling in just north of $11 billion.

There are very few instances where the same stock appears in multiple owners’ top five holdings – clearly, they’ve developed their own investment strategies and preferences. Buffett, himself, has shared many life advice tidbits in order to be successful, and his investment-oriented ones include thinking long-term and staying level-headed amid the ongoing and never-ending market volatility.

If you’d like to explore each portfolio’s holdings and portfolio diversity, take a look at our interactive chart slides.

Analyzing Shares by Industry

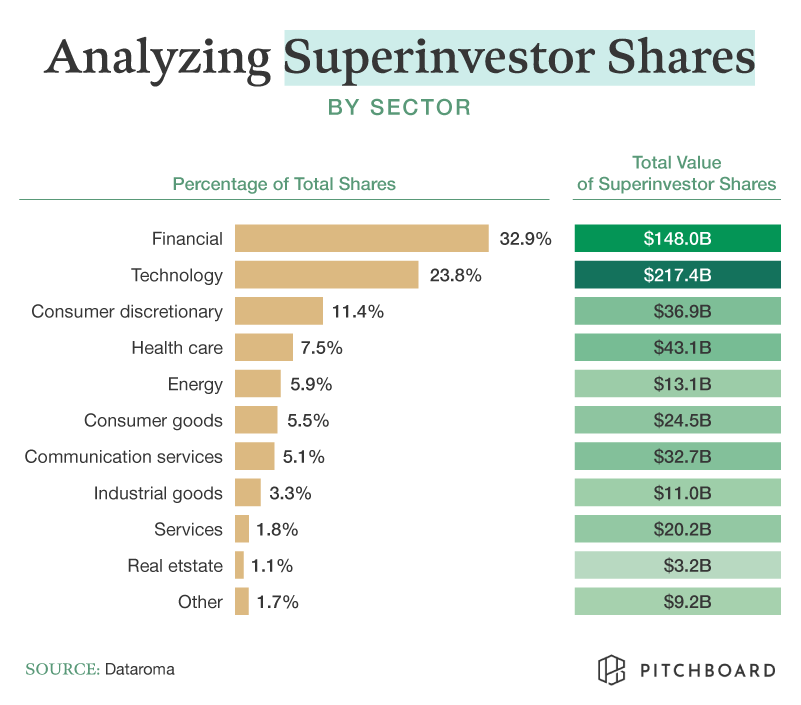

Although nearly a third of superinvestor shares were in the financial sector, the technology industry had the highest value by a margin of close to $70 billion. The consumer discretionary sector accounted for 11.4% of investor shares, valued at a much lower $36.9 billion, and the rest accounted for less than 10% each.

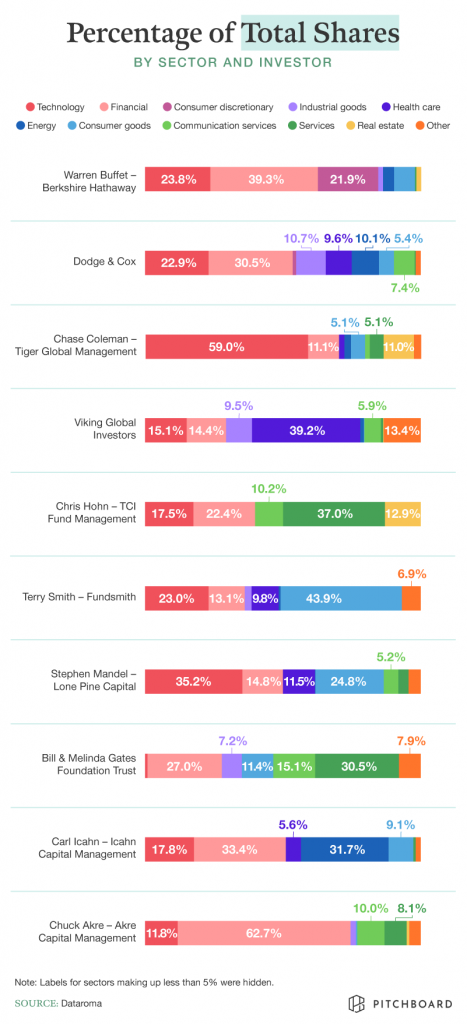

When breaking it down by independent superinvestor portfolio, the financial and technology sectors accounted for a large portion of many of them. Chase Coleman had the highest amount invested in the technology industry, as it made up 59% of his portfolio, whereas Chuck Akre had 62.7% of his dedicated to the financial sector.

Meanwhile, nearly 40% of Viking Global Investors’ portfolio was in health care, and the consumer goods sector made up 43.9% of Fundsmith’s portfolio. Clearly, there’s money to be made regardless of what industry an investor decides to focus their efforts on. A handful of typically strong industries to invest in include food, textiles, and water, as they are essential to life. The technology and health care industries are attractive options as well, due to the continual innovation in both.

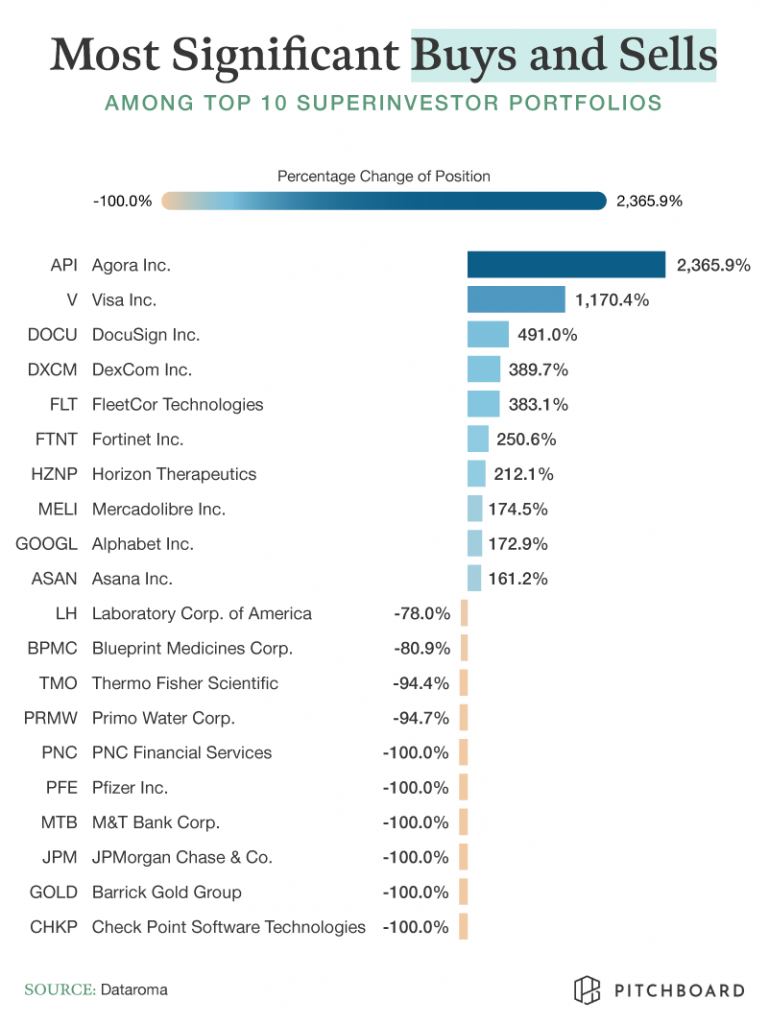

What’s Hot? What’s Not?

During last year’s fourth financial quarter, superinvestors became very interested in certain stocks and much less enthralled with other ones. Agora Inc. underwent the highest change in position by far, rising a whopping 2,365.9% among superinvestor portfolios. The real-time communications company enjoyed $33.3 million in revenue and 2,095 active customers, which amounted to a 74.1% and a 101.2% increase from the fourth quarter in 2019, respectively. Although Visa’s change of position was only half that of Agora’s, a growth of 1,170.4% in investor portfolios is definitely something to write home about as well.

That being said, six companies have lost all of their positioning among top investors. They are from the financial (PNC Financial Services, M&T Bank Corporation, JP Morgan Chase & Co.), health care (Pfizer Inc.), mining (Barrick Gold Corporation), and technology (Check Point Software) industries.

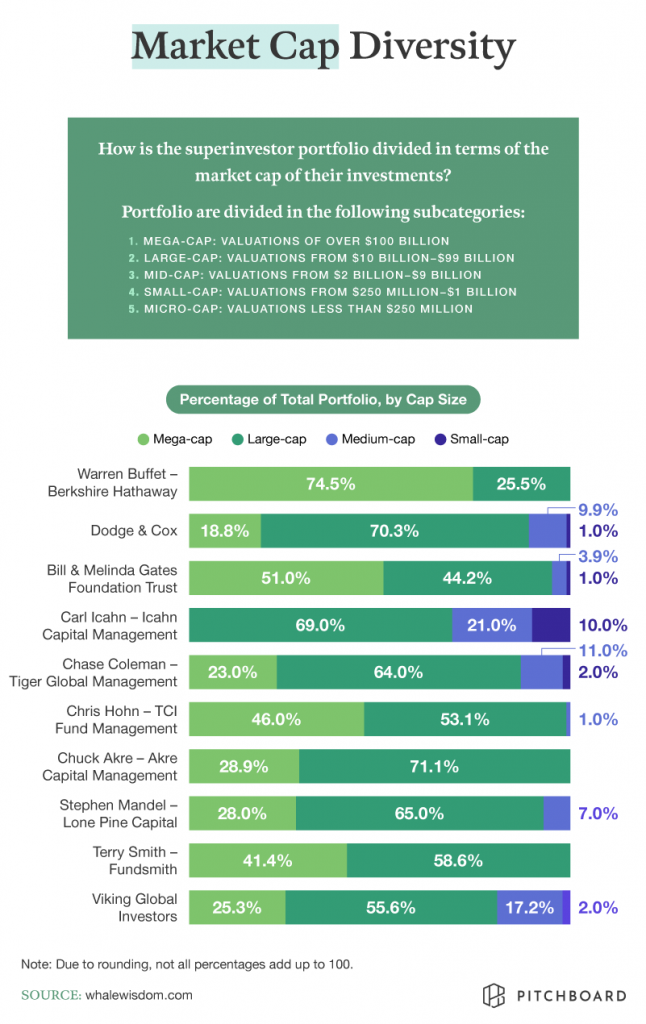

Company Size Counts

Regarding market cap, high-profile investors tended to invest in large- and mega-cap companies. In fact, the portfolios of two of the investors mentioned above were exclusively made up of them. Some liked to invest a little in mid-cap companies, but it was rare to invest in small-cap ones, aside from Carl Icahn where they account for 10% of his portfolio.

There’s a reason why superinvestors tend to put their money in large- and mega-cap stocks. As Warren Buffett preached, long-term success is essential, and investing in bigger corporations allows for increased stability – due to their well-established reputation and influence, it’s unlikely for one to encounter an economic situation detrimental enough to render them insolvent. Smaller companies have less stability, and while investing in them can pay off big time, it’s always a riskier play.

Different Paths, Same Goal

If there’s one thing we’ve learned, it’s that there’s more than one way to make money. From the superinvestors mentioned throughout this article, one’s top five holdings were almost never found in another’s. That being said, they had similar strategies on a more macro level, like the types of industries they tended to invest in (financial and technological sectors) as well as their preferences in regard to market cap (large and mega).

With so much information available for investment tips and tricks, it’s important to discern what’s helpful from harmful. Luckily, at PitchBoard, the only thing you’ll learn how to do is maximize your wealth. Acting as an exclusive social platform for high net-worth investors, you can count on the community to help you make informed investment decisions. To learn more about joining this prestigious group and setting yourself up for long-term success, head over now to get started.

Methodology and Limitations

We scraped and analyzed superinvestor portfolio data from Dataroma in order to explore the contents of a superinvestor portfolio, common stock holdings, and portfolio diversity among other factors. All data comes from Q4, 2020. We also used data from whalewisdom.com to explore how superinvestor portfolios varied by market cap to understand business size diversity in their investments. Market sector analysis was done by grouping each superinvestor stock and its number of shares into its sector category.

Fair Use Statement

We hope that you’ve learned a thing or two from the top investors in the world and are feeling inspired to learn more about the intricacies of the stock market. If you know a friend or family member that might be interested in this article, feel free to send it their way. We just ask that you do so for noncommercial purposes only and to please provide a link back to the original page so contributors can earn credit for their work.