Real Estate offers exposure to tangible assets with bond-like safety, and the potential for equity-like upside

Many investors have gravitated to both residential and commercial real estate in an era where interest rates are low and bonds offer yields that can fail to keep pace with inflation.

Common types of Real Estate investment strategies

Core

Core-Plus

Value-Add

Opportunity

Distressed Debt/Mezzanine

Real Estate investments have the potential to provide a steady income stream and build wealth over time

Funds that invest in Real Estate may consider investing in debt and equity securities in residential and commercial properties for both capital appreciation and income generation objectives.

They may also raise capital by borrowing, which can be particularly attractive in today’s low interest rate environment.

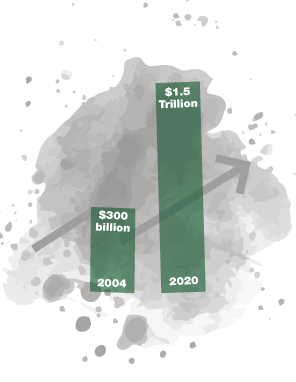

Investments in Real Estate have been steadily growing, with total assets under management rising from $300 billion in 2004 to $1.5 trillion in 2020, according to PwC.

The risks and rewards of Real Estate investments

Real Estate as an asset class is slightly different from other alternatives – being a hard asset, location and local economies can affect valuation to a greater degree than in traditional equity markets. Additionally, Real Estate is a cyclical industry that can be prone to booms and busts.

Risks

For Real Estate investors, timing can be everything as the industry is cyclical and there are often lengthy lockup periods which can affect liquidity. The use of leverage can be a double-edged sword.

Rewards

Besides the potential for enhanced returns in both debt and equity investments, real estate can stave off inflationary pressures and also allow diversification to protect investors’ portfolios against swings in equity markets.

Stay ahead of the curve

Real estate investments allow diversification into hard assets and can provide steady income along with capital growth.

Finding alternatives with PitchBoard

Finding alternatives with PitchBoard

We designed PitchBoard to make it easy to find alternative investments and receive recommendations from close friends and colleagues.

With our platform, you can search hundreds of alternative funds and managers to find the right fit for your portfolio and investment approach.