Private Equity offers a great menu of investment strategies along with operational control

Private Equity funds invest in private businesses, and often look to acquire controlling stakes in entities with the goal of improving operations and enhancing growth.

Common types of Private Equity strategies

Leveraged Buyouts (LBO)

Growth Capital

Distressed and Special Situations

Secondaries

Infrastructure

Private Equity investments are made to acquire ownership interests in private business entities. These are typically controlling equity positions, made with the intention of improving the business or providing the expertise to accelerate the business’ growth potential. These strategies could entail more risk, particularly due to increased leverage.

Private Equity funds continue to draw interest as high returns and lower perceived volatility drive inflows

Private Equity funds can own or operate businesses that don’t trade on public markets. As a result, owning units of a fund may offer exposure to a growing sector or company. It can also provide some diversification for an investor’s overall portfolio.

With the use of leverage, Private Equity funds can increase the profits realized by investors. Debt can be non-recourse to the fund’s other portfolio holdings, providing some protection from risk.

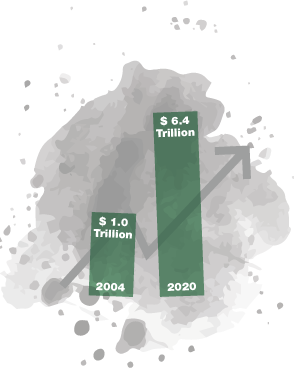

Investments in Private Equity have been steadily growing, with total assets under management rising from $1.0 trillion in 2004 to $6.4 trillion in 2020.

The risks and rewards of Private Equity investments

Private Equity investments entail a risk profile different from other alternative assets, and capital is typically locked up for longer investment horizons.

Risks

Long term investments, often with lock-in periods, can mean much lower levels of liquidity for investors. Additionally, companies could still be affected by broader economic factors and may not perform in-line with the original investment thesis.

Rewards

Private Equity investments can offer higher prospective gains than public entities along with the potential for diversification and exposure to growing sectors. The lack of a daily ‘mark-to-market’ vs. public peers can also mean relatively less perceived volatility.

Stay ahead of the curve

Private equity investments can allow investors more control over businesses and can enhance returns in exchange for longer holding periods.

Finding alternatives with PitchBoard

Finding alternatives with PitchBoard

We designed PitchBoard to make it easy to find alternative investments and receive recommendations from close friends and colleagues.

With our platform, you can search hundreds of alternative funds and managers to find the right fit for your portfolio and investment approach.