Venture Capital offers exposure to fast growing businesses led by ground-breaking founders

Venture Capital funds concentrate capital on emerging and evolving sectors like clean technology or artificial intelligence, with the expectation that returns in the long-run will outweigh the risk of investing early.

Types of Venture Capital funding

Seed Capital

Startup Capital

Early Stage Capital

Expansion Capital

Late Stage Capital

Bridge Financing

Venture Capital firms continue to see strong capital inflows, and 2021 is already shaping up to be a blockbuster year

Investors allocate money to Venture Capital because the potential returns can be very high. By taking a position in nascent businesses that aim to grow exponentially, Venture Capital funds have the chance for gains that generally are not available to larger pools of capital.

Investment targets are typically in industries with the potential for accelerated growth, such as information technology, biotechnology, or the so-called ‘sharing economy.’

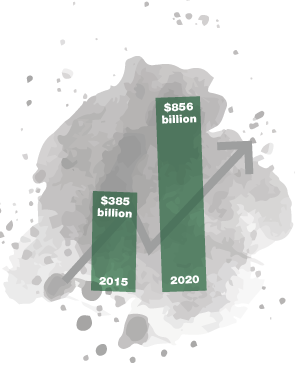

Investments in Venture Capital have been steadily growing, with total assets under management rising from $365 billion in 2015 to $865 billion in 2020, according to studies.

The risks and rewards of Venture Capital investments

Venture Capital funds make investments in a portfolio of early-stage companies, hoping to manage risk through diversification and gaining exposure to multiple avenues of upside optionality.

Risks

Venture Capital funds rely on a few companies to compensate for the ones that do not succeed. If this balance does not play out, returns may not be in-line with expectations. Additionally, obtaining liquidity is difficult as capital tends to be locked up for longer periods.

Rewards

Early-stage investments in businesses that have potential for strong growth can lead to attractive returns for successful funds. Venture Capital investments also provide diversification benefits as portfolios are exposed to secular growth themes that are less vulnerable to macro-economic forces.

Stay ahead of the curve

Venture capital investments offer the hunt for the next unicorn; risk management and diversification are key elements for successful strategies.

Finding alternatives with PitchBoard

Finding alternatives with PitchBoard

We designed PitchBoard to make it easy to find alternative investments and receive recommendations from close friends and colleagues.

With our platform, you can search hundreds of alternative funds and managers to find the right fit for your portfolio and investment approach.