Do well while doing good

Grow your wealth while aligning your portfolio with your personal values by investing in Environmental, Sustainable and Governance (ESG) funds.

What’s the buzz about ESG

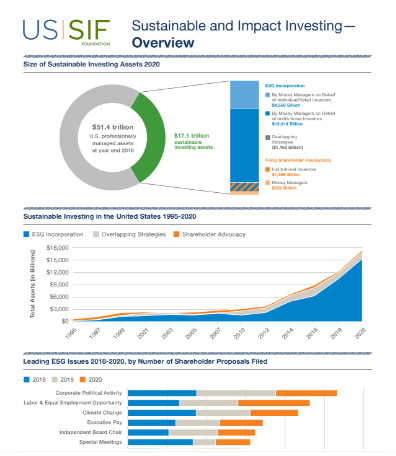

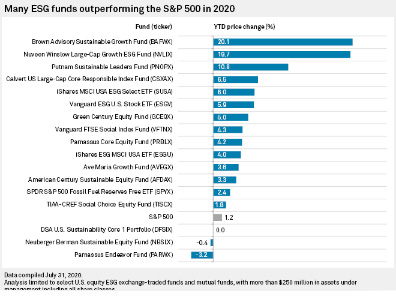

ESG funds and investment approaches use a set of criteria that goes beyond typical financial data, measuring the triple bottom line of companies from the standpoint of profitability, environmental and social responsibility. The result is a more detailed understanding of the value of a company, now and in the future. In recent years, ESG has gained more prominence as funds seek to future-proof their investments, including a record-breaking year for ESG investments in 2020.

Doing good and looking good

ESG funds and investment approaches use a set of criteria that goes beyond typical financial data, measuring the triple bottom line of companies from the standpoint of profitability, environmental and social responsibility. The result is a more detailed understanding of the value of a company, now and in the future. In recent years, ESG has gained more prominence as funds seek to future-proof their investments, including a record-breaking year for ESG investments in 2020.

Finding ESG investments with PitchBoard

Funds and managers that offer ESG investments and strategies on PitchBoard are marked with a green leaf symbol.

Each fund and manager may have their own approach to assessing ESG criteria, so you should qualify them as you would any investment opportunity.

You can also recommend ESG funds and managers that you know to other members of the PitchBoard community. The more opportunities we have to invest in funds that fit our portfolio and our values, the bigger impact we can make together.

Make a global impact with your investments

Investment opportunities in ESG funds include:

Gender Equity

Gender equity funds are directed towards investments that support the value of women as business owners and their role in the larger community.

Racial Equality

Funds directed towards racial equality target investments a variety of areas including under-served communities. These investments often overlap with government assistance programs such as Keystone Opportunity Zones.

Sustainability

Funds targeted towards sustainability invest in businesses that conserve the environment and respect the lands of local and indigenous people.

Water Scarcity

Access to clean drinking water is a problem throughout the developing world. Funds that invest in water scarcity target businesses that offer affordable and scalable solutions for bringing clean drinking water to impoverished communities.

Low and Zero – Emissions Technology

Cleantech funds invest in companies that are developing more renewable energy sources and distribution technologies.