Hedge Funds offer flexible investment strategies like no other

Hedge funds are a broad term for a collection of investment vehicles that employ varying strategies that allow investors to protect their investments against declines in the equity market.

Common types of Hedge Fund strategies

Long/short equity strategies

Global macro strategies

Quantitative funds

Fixed income/credit funds

Commodity funds

Merger arbitrage strategies

Hedge Fund managers employ several strategies to keep their investors relatively safe from uncertainty in the equity markets, such as taking short positions on stocks to protect against volatility in major market indices, while maintaining some long positions for capital appreciation.

Hedge Funds have shown resiliency through the volatility caused by COVID-19 and are attracting significant investor attention

Hedge Funds are pooled and actively managed funds that are highly flexible in terms of taking long or short positions, using derivatives strategically or for hedging, and leverage for enhancing returns.

They can invest in one sector or the market as a whole including commodities, debt, and derivatives.

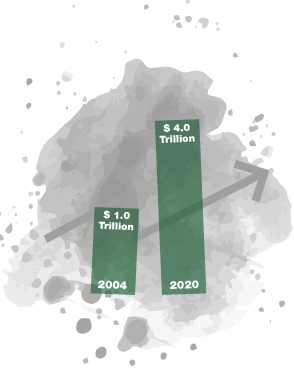

Investments in Hedge Funds have been steadily growing, with total assets under managements rising from $1.0 trillion in 2004 to $4.0 trillion 2020, according to PwC.

The risks and rewards of Hedge Fund investments

Given the wide range of types of Hedge Fund strategies, it is important to understand the associated risks and rewards they offer.

Risks

Hedge Funds may not be as liquid as some investors would prefer as redemptions are typically only allowed quarterly and may even be restricted in adverse environments. In addition, using leverage could lead to losses.

Rewards

Hedge Funds are more flexible than many other types of investments and can offer lower volatility and higher returns to investors by using tools such as leverage and derivatives.

Stay ahead of the curve

Hedge funds offer accredited investors access to a range of strategies to reduce portfolio volatility and pursue enhanced returns.

Finding alternatives with PitchBoard

Finding alternatives with PitchBoard

We designed PitchBoard to make it easy to find alternative investments and receive recommendations from close friends and colleagues.

With our platform, you can search hundreds of alternative funds and managers to find the right fit for your portfolio and investment approach.