Portfolio Management, REIMAGINED.

For high net worth individuals, managing one’s portfolio can be challenging. Robo platforms don’t give you an advantage for having outsized wealth. Wall Street sees you as a big fee source. And finding and researching investment opportunities takes precious time that you’d rather be spending elsewhere.

Charlie Munger once said: “Finding a single investment that will return 20% per year for 40 years tends to happen only in dreamland. In the real world, you uncover an opportunity, and then you compare other opportunities with that. And you only invest in the most attractive opportunities. That’s your opportunity cost. That’s what you learn in freshman economics. The game hasn’t changed at all.”

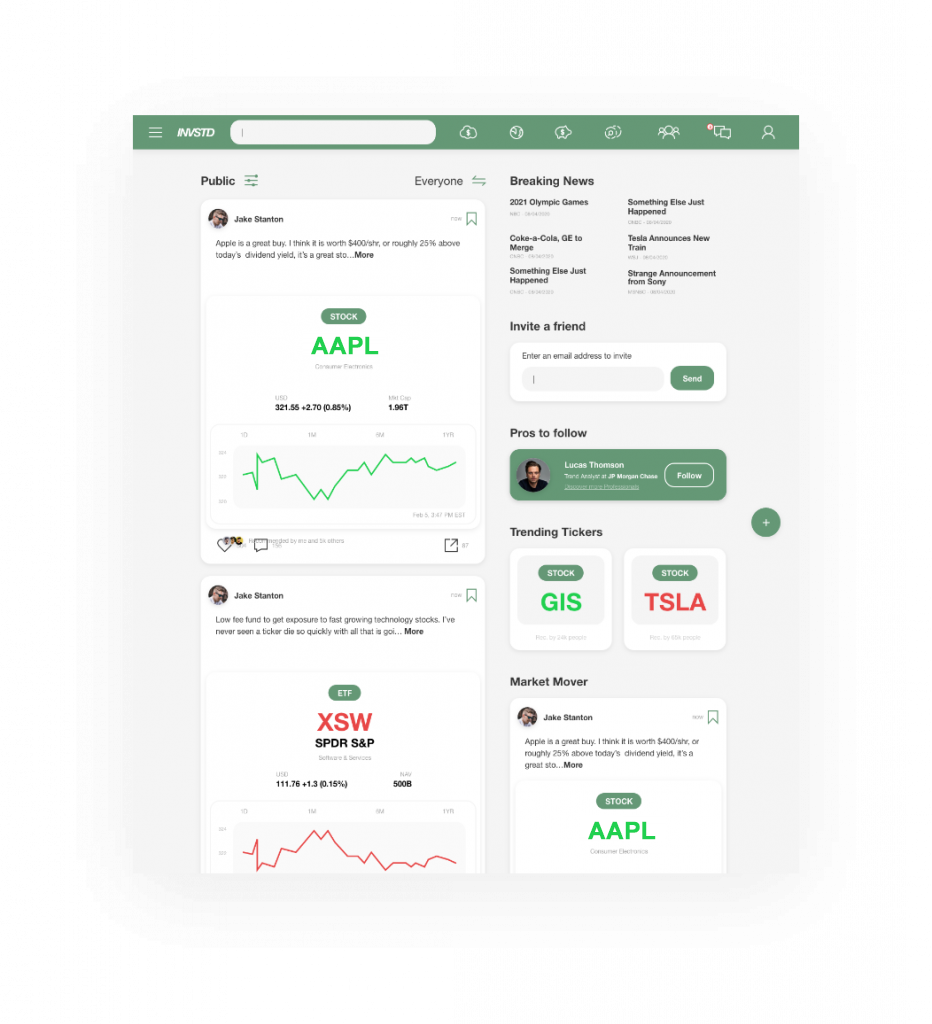

At PitchBoard, our goal is to put all the opportunities available to you at your fingertips, so that you can take money out from under the mattress and always be invested in your best ideas.

Determine your Optimal Asset Allocation

- Asset allocation is often based on computer models with abstract inputs on risk tolerance and time horizon. Investors are often paralyzed when worried about the market, and can leave money on the table at the wrong times

- Augment this approach by viewing the actual allocations of your peers and professionals, gaining insights into your trusted network’s risk/return exposure

- Connect with professionals who are experts in asset allocation to get personalized advice

Optimize your Portfolio Construction Process

- Investors are often limited to the most trafficked stocks (i.e. FAANG) or trust idea generation to managers not incentivized to maximize returns

- Get recommendations from other high net worth investors on their best ideas, and put your money to work immediately

- Take advantage of your high net worth status, diversifying your options with private investment opportunities not typically available to the general public and with low correlation to traditional assets

Stay Nimble withPortfolio Rebalancing

- In today’s uncertain economy, it’s more important than ever to keep your portfolio fresh in the face of the multitude of market risks

- Keep up to date on how your friends and family are tilting their portfolios’ asset allocation and investments

- Get real-time views from real professional money managers on the market