Why should you invest in real estate? Because real estate is a unique asset class that can grow your wealth and provides passive monthly income. Here are some compelling statistics:

- Real estate investment returns have beaten the returns of stocks over historical periods. For example, from 2000-2020, investing in real estate would have generated an average 12.0% return, versus 8.2% for the S&P 500.

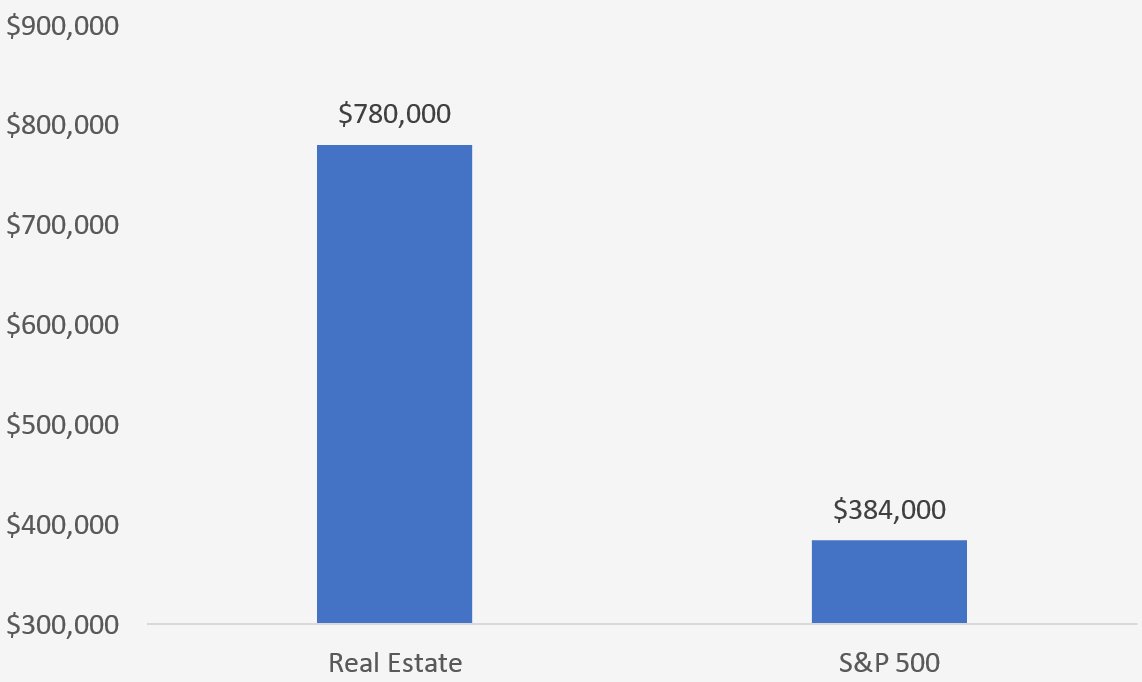

- Because of the power of compounding, a $100,000 real estate investment in 2000 would have grown to $780,000 by 2020. This amount is double the $384,000 that the same investment in the S&P 500 would have returned.

- More investors want to invest in real estate and are allocating increased savings here. Total real estate equity capital has more than doubled in the past ten years. Public equity REITs have grown from $400 billion in 2010 to over $1 trillion today.

- For those wanting to invest in real estate, the asset class is becoming more accessible. For example, the number of public equity REITs has increased over time, as has the number of private real estate funds. Also, crowdfunding has enabled investors with less money to make real estate investments online.

Real estate investments are an ‘alternative asset’ class distinct from stocks and bonds and can be a good diversification tool in an investor’s portfolio. After reading this guide, you should understand how real estate can grow your wealth, the risks to look out for, and how to be successful in investing in real estate.

Estimated reading time: 66 minutes

Table of contents

- Real Estate Investments Can Generate Attractive Returns

- What makes Real Estate a Good Investment?

- How to Start to Invest in Real Estate?

- How to Begin Evaluating Real Estate Investments

- Invest in the Right Type of Real Estate

- Residential vs. Commercial

- Multi-Family Real Estate Investments: Steady Demand

- Office Real Estate Investments: Levered to the Business Cycle

- Retail Real Estate Investments: Consumer Spending Dominates

- Industrial Real Estate Investments: Enjoying its Day in the Sun

- Self-Storage Real Estate Investments: Supply Constraints Drive Value

- Other Real Estate Investment Property Types

- How to Figure Out How Much to Pay for Real Estate

- Real Estate Investment Strategies Used to Outperform

- How to Invest in Real Estate Investment Trusts (REITs)

- How to Invest in Private Equity Real Estate

- What is a Private Equity Real Estate?

- Benefits of Investing in Private Equity Real Estate

- Risks of Investing in Private Equity Real Estate

- How to Choose a Real Estate Investment Manager

- Scrutinize Sponsor Compensation Arrangements

- Tax Considerations with Private Real Estate Investments

- Crowdfunding: How to Invest in Real Estate with Little Money

Real Estate Investments Can Generate Attractive Returns

Real estate investments can be an essential addition to investment portfolios. Not only does real estate provide benefits such as diversification and passive income, but it also can grow at rates faster than the overall stock market over long periods. Below we detail trends in performance, capital flows, and portfolio allocation.

Real Estate Investments Can Beat the Stock Market

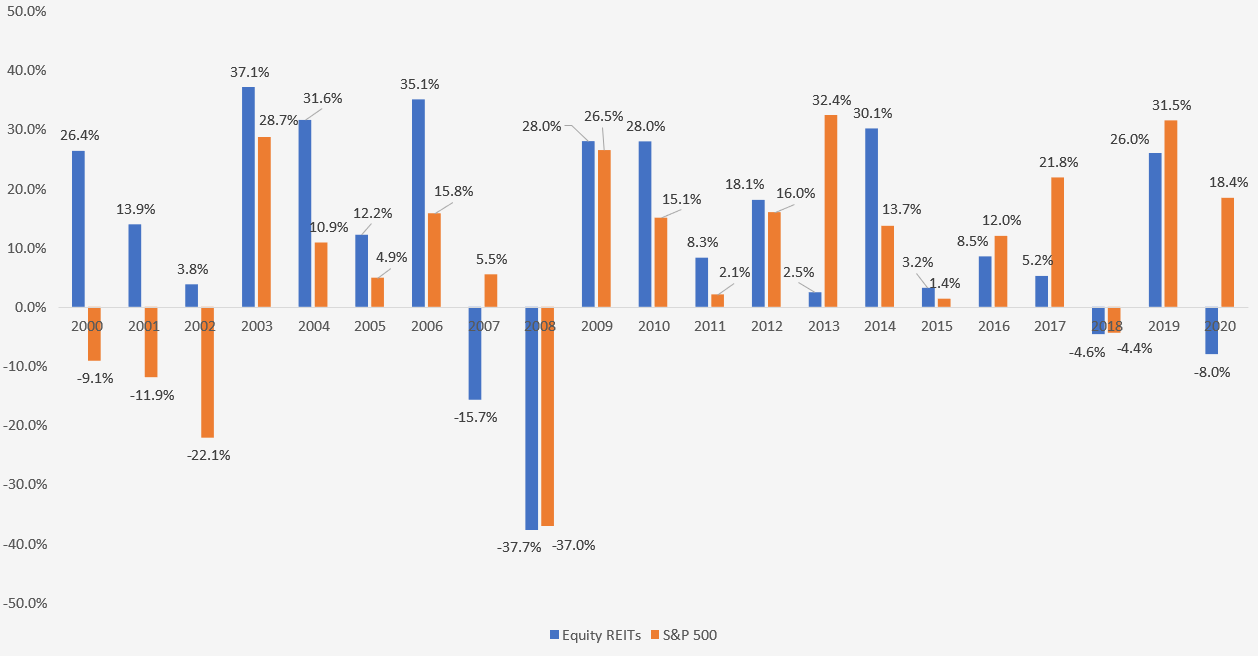

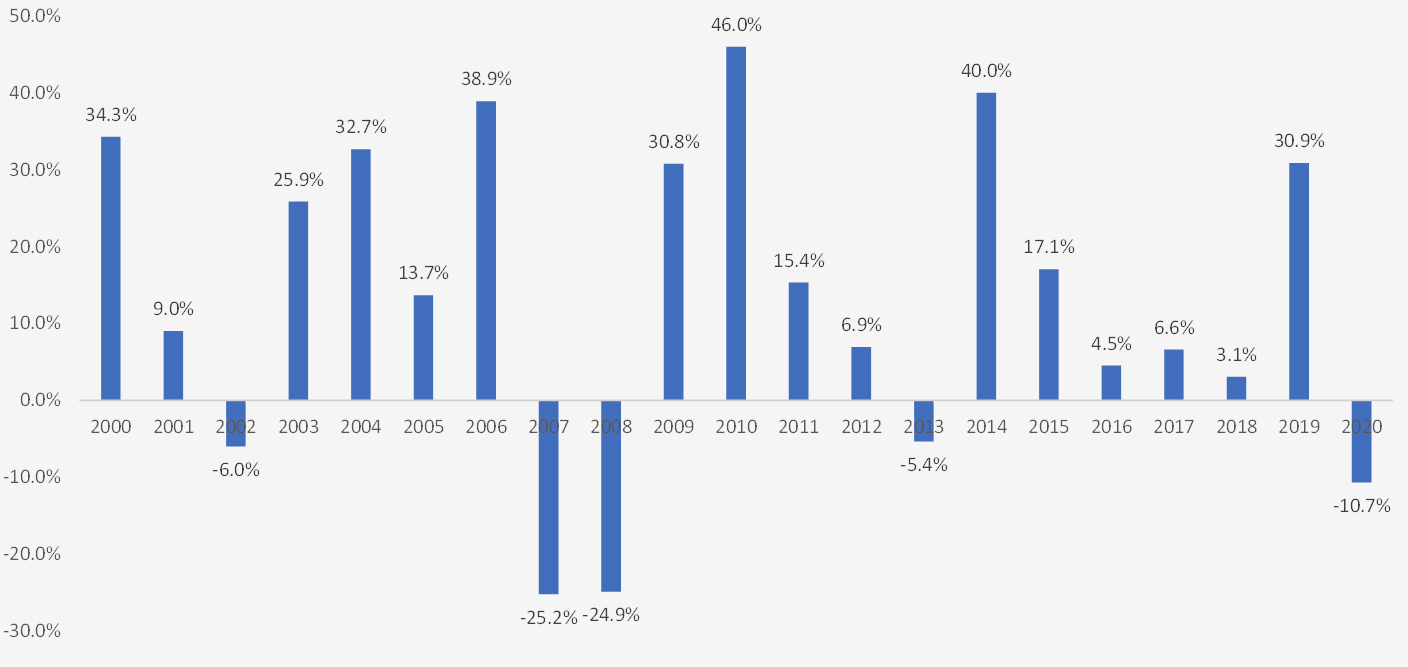

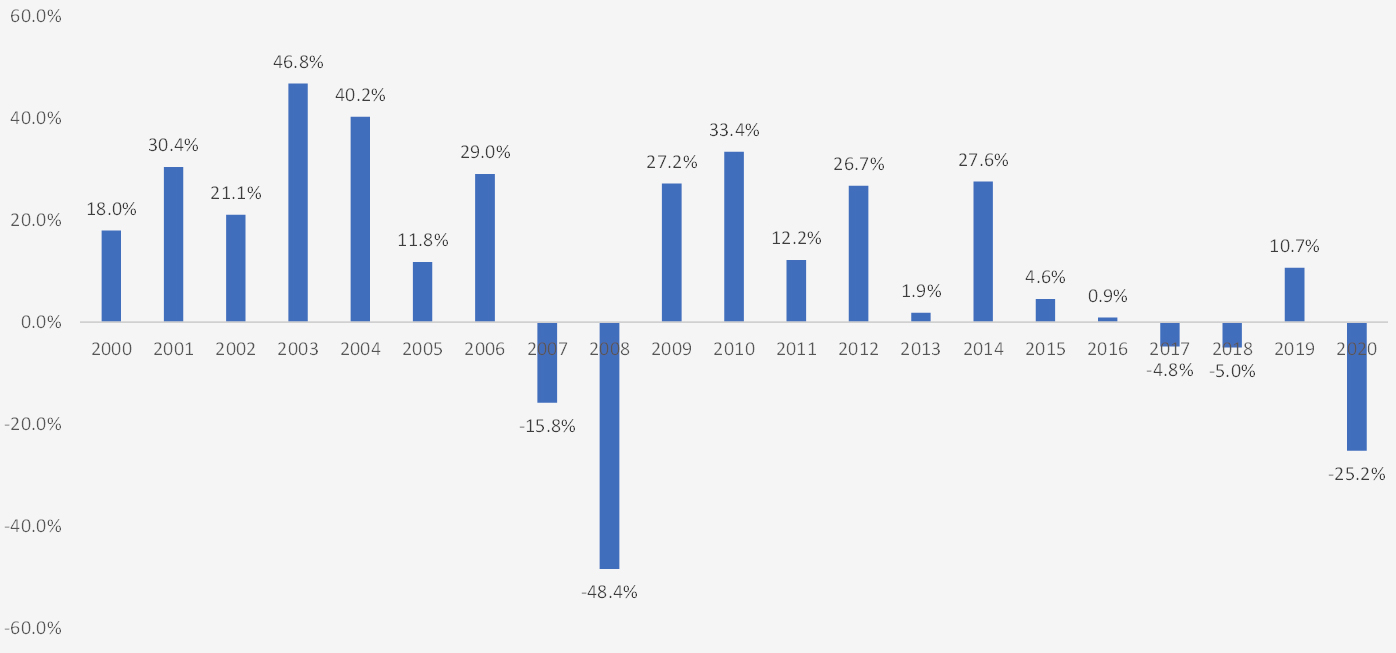

In Figure 1, we compare the total returns of the NAREIT equity index, which is a proxy for real estate performance, with that of the S&P 500, which is a proxy for stock performance. While yearly leadership can change between real estate and stocks, the average from 2000-2020 has been 12.0% for real estate versus 8.2% for the S&P 500.

Figure 1: Yearly total returns of equity REITs and the S&P 500

Another proxy for real estate returns would be to examine the performance of private equity real estate. Private equity real estate funds are similar to REITs in that they hold portfolios of real estate assets but can have different management styles.

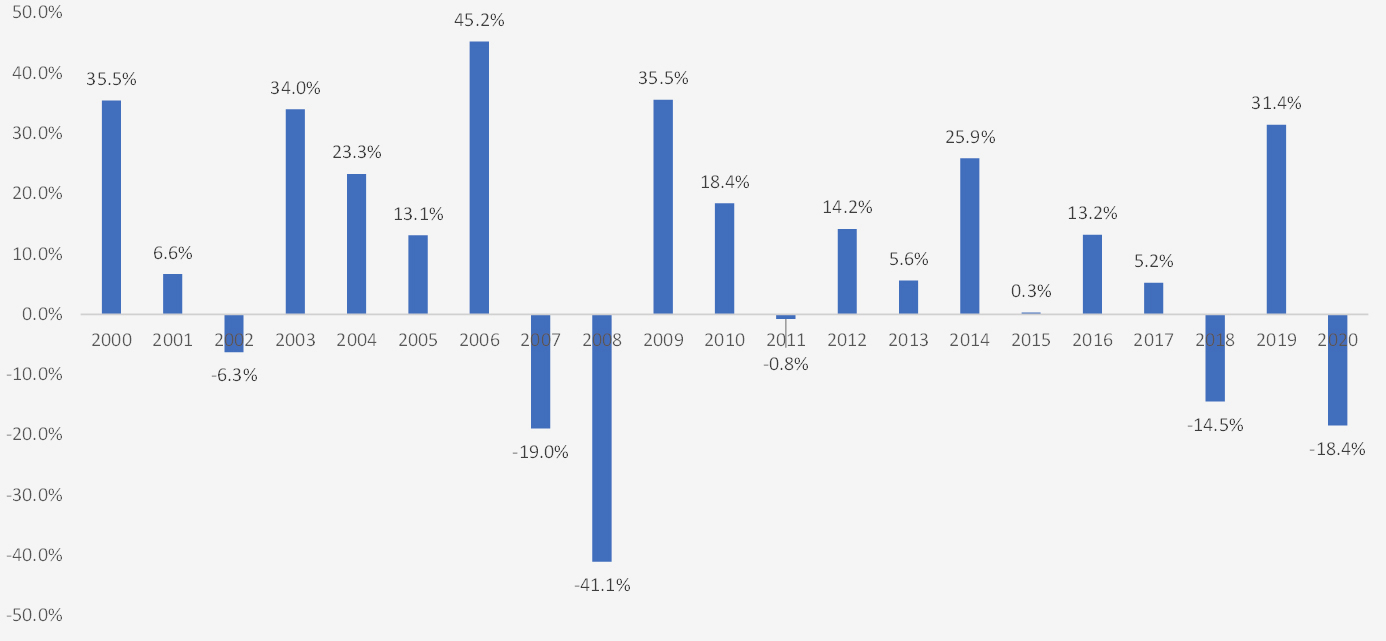

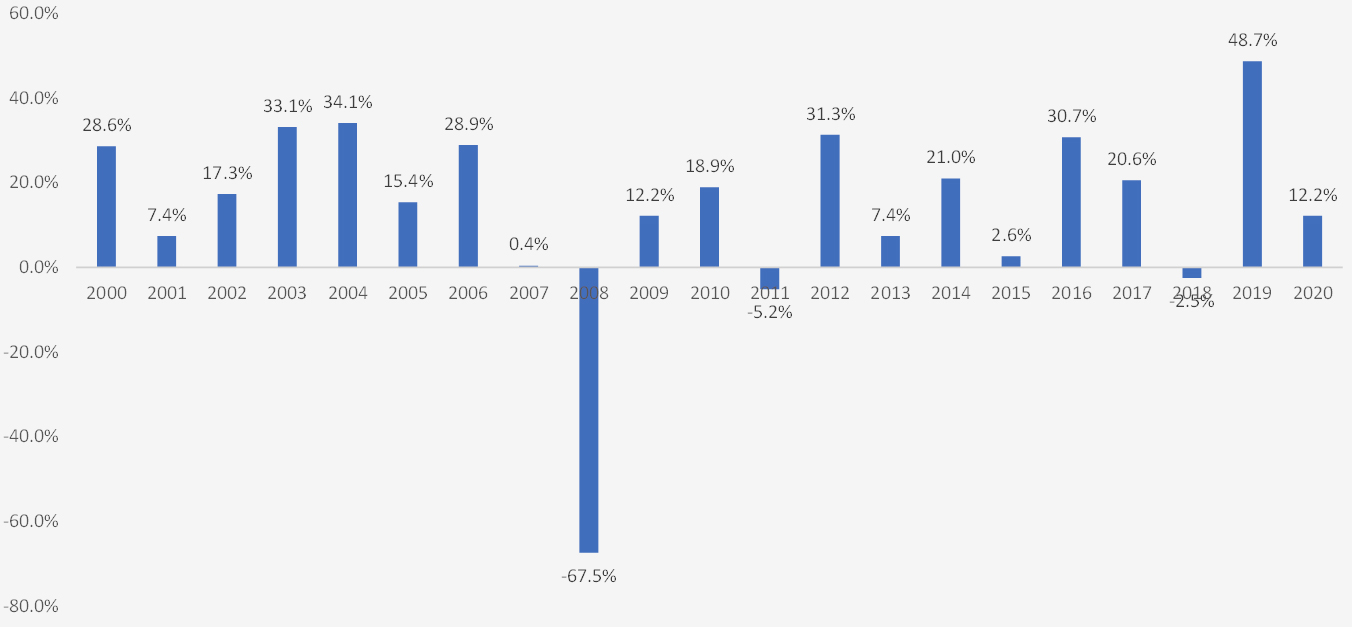

Figure 2 attempts to compare the performance of private equity real estate with that of the NAREIT equity index. Unfortunately, measuring performance can be challenging, given the lack of transparency in returns. As a result, academics use different methodologies to approximate performance, with public market equivalents (PME) being popular. This concept uses a ‘horse race’ approach to comparing the cash flows of different vintages of private funds by their commensurate public market equivalent.

See our Ultimate Guide to Investing in Private Equity to learn more about the performance of private investments.

Figure 2: Private real estate fund performance versus equity REIT performance, by vintage year

We see that private real estate funds, on average, have similar returns to public equity REITs and can outperform stocks over long periods. Here the average performance for private real estate is 10.1% versus 6.1% for the S&P 500 from 2000 to 2014. The three academics noted above wrote a recent paper providing more context to private fund performance.

Investments in Real Estate can Compound Over Time

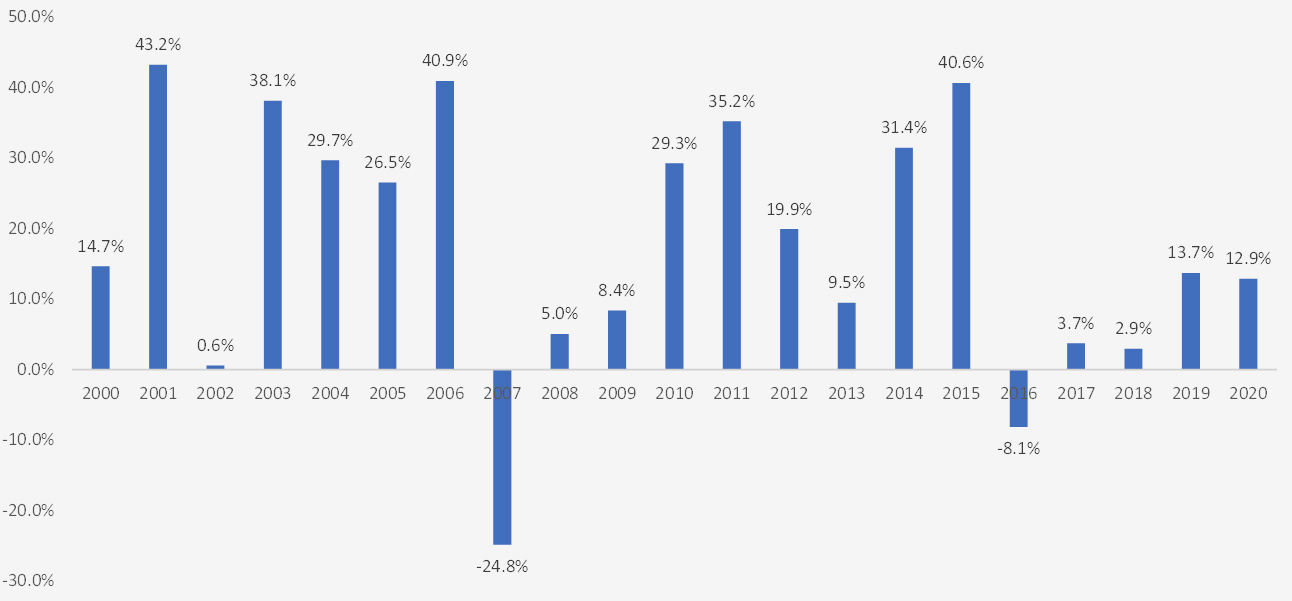

To quantify how seemingly minor differences in returns can compound over time, Figure 3 shows the growth of a $100,000 investment between 2000-2020 between real estate and stocks. Over this period, real estate has returned roughly twice that of the S&P 500.

Figure 3: Growth of $100,000 invested in real estate (as represented by NARETs equity index) versus the S&P 500

However, it is important to caveat that this analysis is susceptible to the periods measured. For example, had we used the period 2015 to 2020, a $100,000 investment in stocks would have resulted in $206,000 versus $130,000 for real estate.

Real Estate is Attracting more Investment Dollars

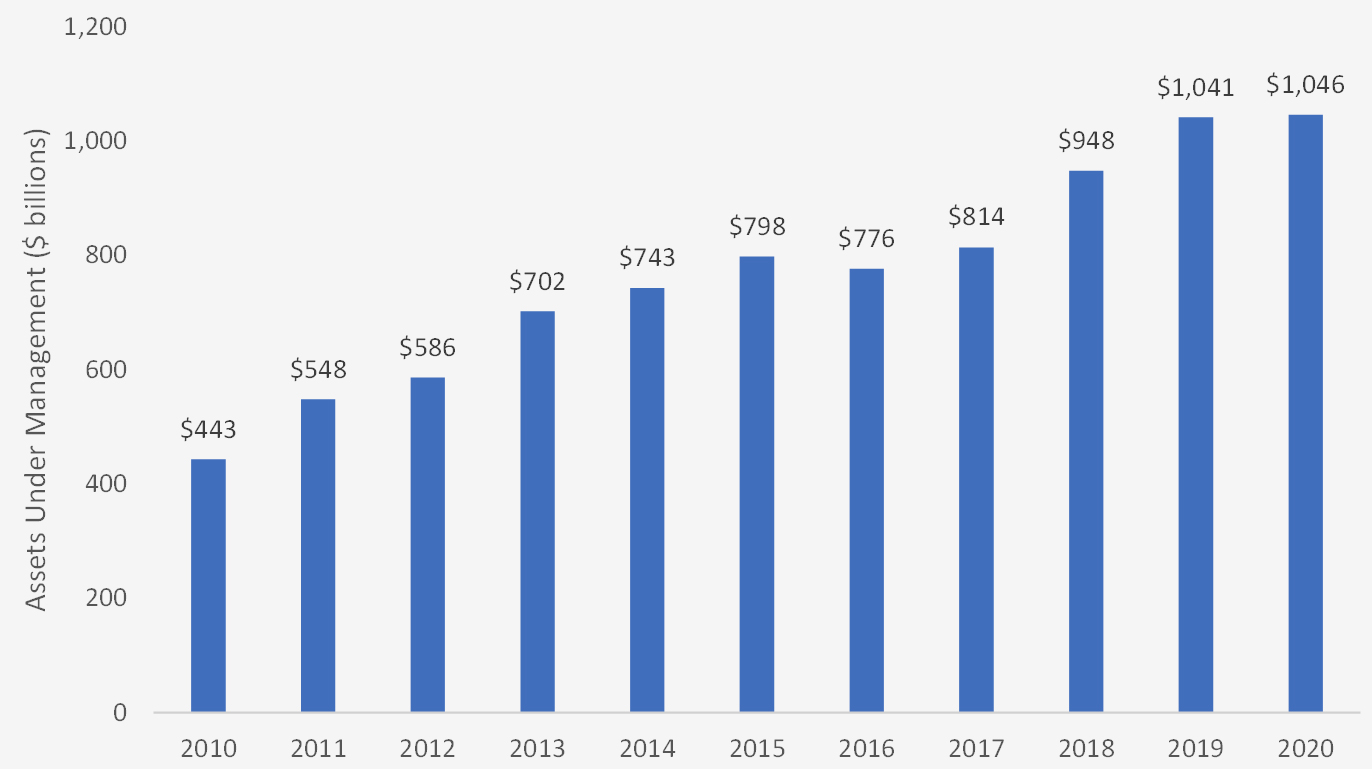

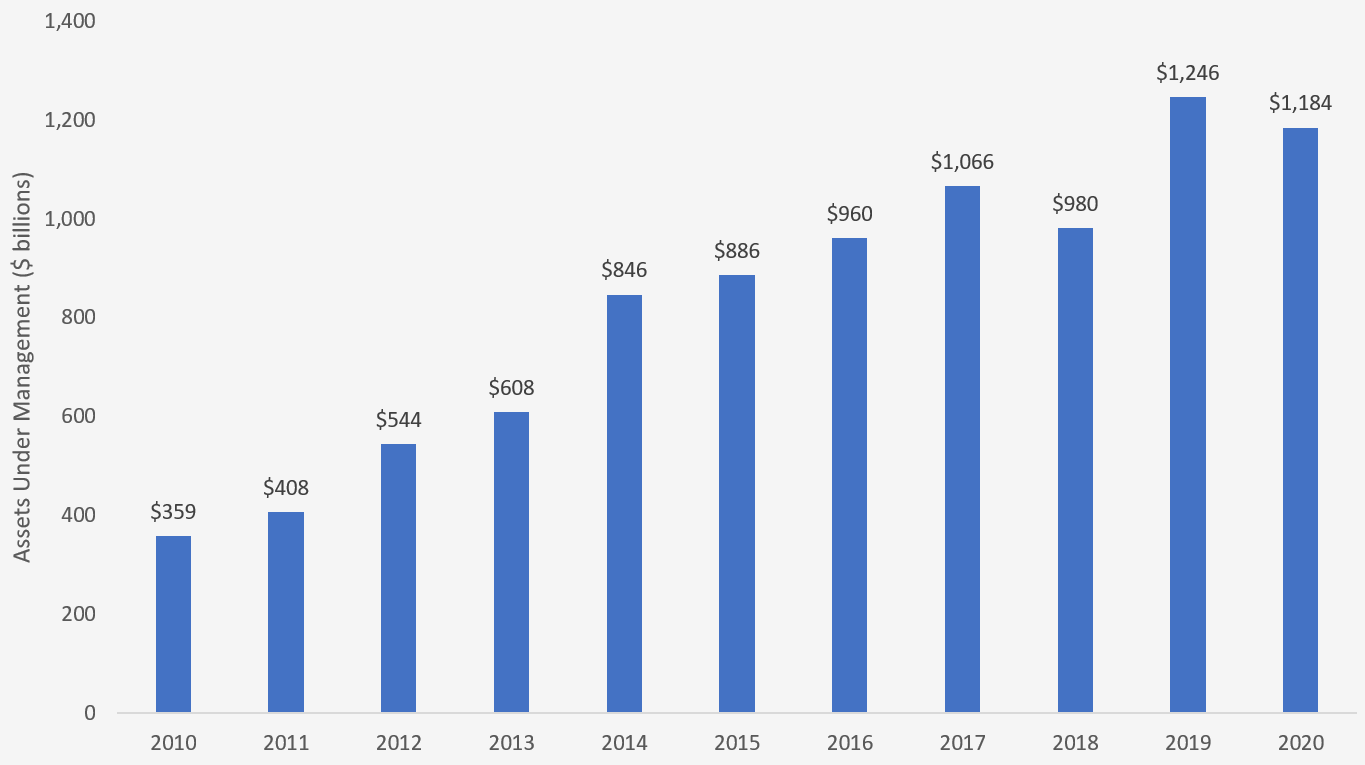

Given the strong performance of investments in real estate, the asset class has attracted increasing fund flows. For example, figure 4 shows the tremendous growth of public equity REITs over the past ten years, from $443 billion in 2010 to over $1 trillion today.

Figure 4: Public equity REIT market capitalization

Private real estate funds are also seeing increased investor interest. Assets under management has shown strong growth over the past ten years, as shown in Figure 5, growing from $359 billion in 2010 to $1.2 trillion in 2020.

Figure 5: Private real estate assets under management

Investors are Allocating more of Their Portfolios Towards Real Estate Investments

In addition to real estate investments gathering more investors and assets, portfolios are increasingly tilting towards real estate. Increased allocations indicate that investors believe that real estate will produce better risk-adjusted returns than other asset classes

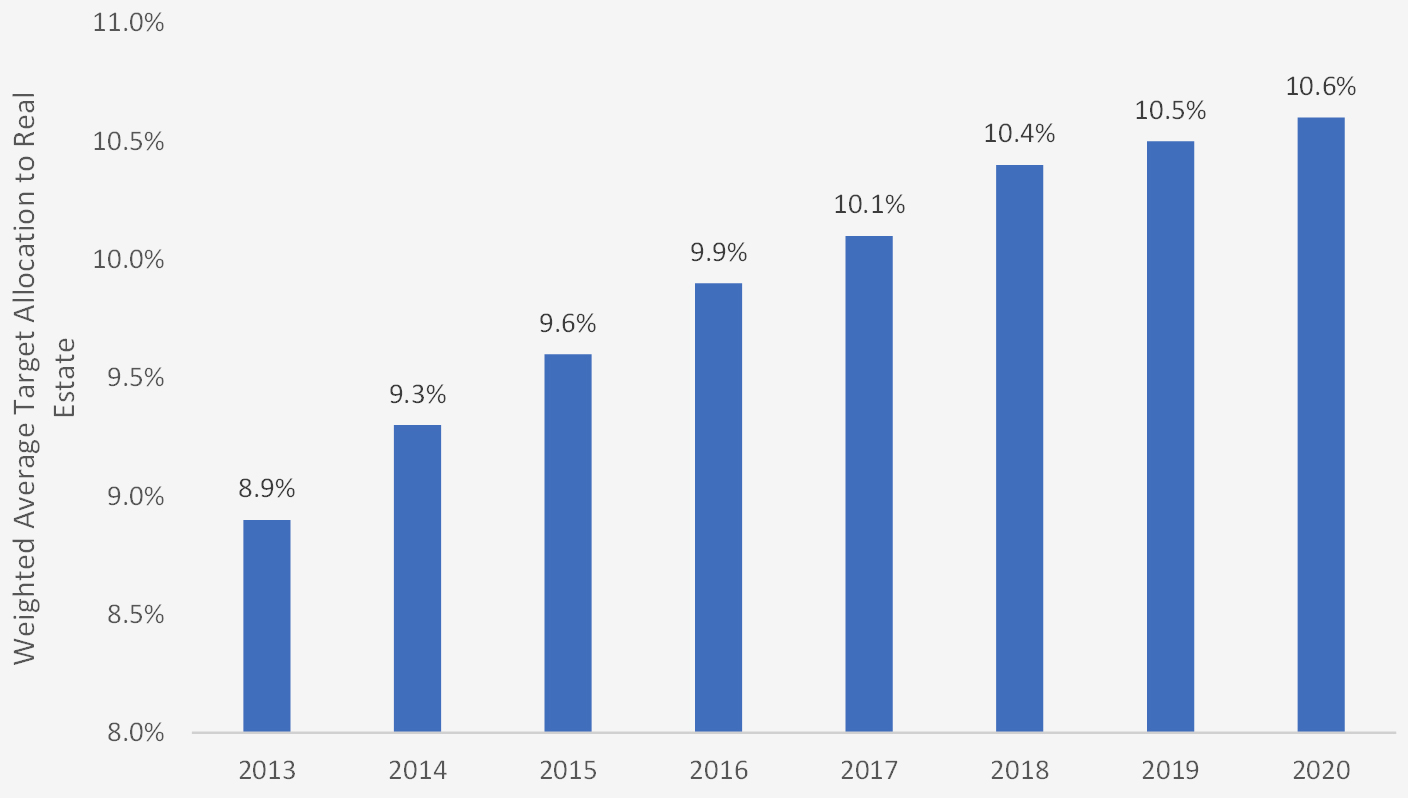

Figure 6 is from Cornell University’s Baker Program in Real Estate and Hodes Weill & Associates annual survey of institutional real estate. Target allocations have increased from 8.9% in 2013 to 10.6% in 2020.

Figure 6: Institutional target portfolio allocations to real estate

Having made the case that investments in real estate can grow wealth at solid rates over time, we next dive into the details on the drivers of real estate returns.

What makes Real Estate a Good Investment?

As we’ve seen above, real estate investments have the potential to appreciate at attractive rates.

Real estate investments in the United States have generally benefited from population growth and per capita income over the long term. Another favorable tailwind has been the decline of interest rates. Below we discuss the drivers of real estate performance in greater detail.

Important Factors that Drive Real Estate Returns

Several factors drive real estate investment returns, including:

Demographics Drive Destiny

At the highest level, the city will strongly impact the level of appreciation of the real estate investment over time. There is a saying in real estate that “demographics drive destiny,” which implies that characteristics such as population trends and total economic output that a city generates matter.

Investing in a city experiencing net new migration and strong economic growth will have a ‘rising tides lift all boats’ impact on real estate assets. We hosted a podcast with veteran real estate investor Brian Adams of Excelsior capital. He discusses the effects of favorable demographic trends on real estate values in the Sunbelt region of the US.

Properties Levered to the Best Trends

The supply and demand characteristics of the type of real estate asset will determine the rents that a property owner can charge a tenant. For example, a landlord owning a multi-family apartment in a growing city where renters have less options can charge higher rents over time, especially if new construction does not keep up with demand. On the flip side, real estate used for retail purposes can experience softening rents as purchases shift online.

Class A Locations

Real estate assets positioned in areas with higher quality traffic or demographics, such as high household incomes, would be more desirable within a particular market than ‘outskirt’ sections of a locality. Real estate professionals refer to location sometimes as Class A, B, or C. Here, Class A would be in desirable, trafficked prime areas of a town, versus Class C being less desirable.

Investing in areas that experience growth or gentrification can impact investment returns.

Tightening Cap Rates

The income yield that investors demand when purchasing an asset can change and impact investment returns. Buying a property that investors require less income from will be a positive driver of returns.

For example, if a property generates a yearly income of $10,000 and investors demand a 10% return when purchasing the asset, its value would be $100,000. However, if the market environment changes and investors require a 5% return, the property’s value would double $200,000.

We will discuss the drivers of cap rates in more detail below. A positive feature of real estate investments has been the general decline of interest rates for the past 30 years, which adds a sizeable premium to assets held for the long term.

Responsible Use of Debt

The amount of debt and the cost of debt can impact the returns that a real estate investment generates. For example, say you purchase a real estate investment for $100,000, and you financed it with 80% debt and 20% equity. Should the property grow in value by 5% in year one, it would be worth $105,000. Since all the gain goes to the equity holder, the initial investment would appreciate 25% from $20,000 to $25,000.

Using a lower debt ratio would result in a lower rate of return. In addition, the cost of the debt impacts how much passive income the property ultimately generates, which also influences the rate of return.

A positive feature of real estate investments is that they can support higher levels of debt than other assets because they have collateral (hard assets in the form of building and land) that a lender can seize in the event of a downturn.

Tax Arbitrage

Numerous tax strategies are uniquely available to real estate investments that can strongly impact the returns realized. For example, structures (i.e., REITs) treat income as passive and are not subject to taxes at the entity level. This structure compares favorably to private equity and other operating businesses, where earnings are subject to ‘double taxation’ at the entity and personal levels.

Additionally, there are mechanisms like the 1031 exchange, where real estate investors can defer capital gains years into the future, significantly enhancing returns over time. Finally, numerous other strategies exist for savvy investors unique to real estate and are favorable for realizing returns.

More Reasons to Invest in Real Estate

In addition to the direct factors that influence real estate values mentioned above, there are other considerations that can make the case to invest in real estate. These factors include:

Avoid Putting All Eggs in One Basket

Real estate investments are ‘alternative’ investments, distinct from ‘conventional’ investments such as stocks and bonds. As such, they expose investors to different return and risk factors (conventional wisdom holds real estate to be “uncorrelated” to public equities) and can benefit the total risk-adjusted returns of a portfolio.

While there are many ways to manage an investment portfolio, many investors accept Modern Portfolio Theory, which would likely encourage the diversification that real estate brings. Diversification is also helpful from a common-sense perspective of avoiding ‘putting all your eggs in one basket.’

Earn Passive Cash Flow

It is common for real estate investments to generate a passive income that generally arrives at regular and recurring periods. While the yield varies by property type and leverage, it is typically higher than dividends on common stocks. Furthermore, while the overall principle or real estate investment is generally illiquid, the income generated does provide some attractive periodic liquidity to the investor.

Preservation Your Wealth

Real estate investments are often considered good asset preservation tools. While the historical returns have proven robust and competitive with other assets, the expected return of real estate is typically lower than stocks; however, investors are compensated for this by a lower risk profile.

Real estate investments many times display less’ volatility,’ or fluctuation in prices, than stocks. In finance parlance, volatility and risk generally go hand in hand.

Real estate is also considered an inflation hedge. If the dollar’s value depreciates and the general level of prices rises, real estate would theoretically preserve its purchasing power. Because real estate is a physical asset with a finite quantity, it can maintain purchasing power.

An Asset You can Feel and Touch

Finally, real estate can be a relatively easy investment to understand. It’s an asset you can feel and touch, with inner workings that seem less complex than a software platform. Moreover, while real estate investments can be complicated (i.e., distressed or have obscure contracts), their physical nature can impart a layer of emotional security unique to other investments.

Risks to Watch Out for When Investing in Real Estate

There are risks and other factors to consider before making real estate investments, including:

Locked up Capital

Unless you are investing in a public REIT, real estate investments are generally illiquid. So, for example, a property owner wanting to sell out one asset to put the funds to other uses, while possible, could be more difficult relative to other investments.

Finding a buyer could take time because they are high-dollar investments, especially if the market is soft. Further, selling a real estate asset can expose an investor to capital gains taxes built up over the years, discouraging a quick sale.

Excess Debt can be Dangerous

While debt can significantly enhance returns of real estate investments when assets are appreciating, leverage can amplify negative returns during periods of distress or turmoil. Moreover, during the ordinary course of business, the interest payment obligations and mandatory amortization schedules attached to debt decrease the flexibility owners have if they have trouble finding a tenant or collecting rent.

Finally, when the debt matures, and owners are trying to refinance, credit availability could be impaired relative to the initial loan period and negatively impact equity values.

Watch the Economic Cycle

Real estate investments are not immune to recessions or broad economic hiccups. Generally, finding tenants and charging attractive rents relies on a healthy economic activity and demand environment. If those factors weaken, vacancy rates start to increase, and rents grow more slowly or might decline.

In addition, tenants could ask for more improvements, and credit conditions could become more challenging. All of these factors affect the rate of return realized on a real estate investment.

Be Mindful of High Transaction Costs

While there is a general depth to the real estate market, transactions require more negotiation and higher touch than common stocks. For this reason, transaction costs could be meaningful and eat into the realized returns on a real estate investment.

For example, online brokerage firms have driven transaction costs to zero for common stocks; however, they remain at the 6% level for residential real estate transactions.

High-Dollar Investments

Because real estate assets are high-dollar investments, it can be difficult for individual investors to assemble a diversified portfolio of properties. Moreover, even though the real estate can diversify an overall portfolio, if one asset represents the entire allocation, the portfolio could be exposed to undesirable idiosyncratic risk. Idiosyncratic risk is the risk arising from individual securities or positions.

Plenty of Management Responsibilities

While real estate investments and income are considered ‘passive,’ there is often nothing passive about maintaining and operating a real estate property. The cost of the time owners spend managing a property frequently does not get factored into real estate returns, even though it technically should. After all, time is money.

Finding tenants, collecting rent, dealing with repair and maintenance all represent unique challenges and require attention.

Other Risks Relevant to Real Estate Investing

Because real estate is a significant physical asset, it is subject to many additional risks, which could derail a sound investment thesis. For example:

- exposure to natural perils (such as floods and fires) could fall outside of insurance

- liability issues from accidents arising from tenants or development/repair service providers

- liens on a title and a potential lack of clean ownership

- zoning and regulation that the property might be subject

Having reviewed that real estate investments can grow at attractive rates and the drivers of these returns, we now turn to how to invest in real estate and put your money to work.

How to Start to Invest in Real Estate?

As investor interest in real estate has grown over time, so too have the options available for investing. Here we will cover some common ways investors can access the real estate asset class.

Invest in Real Estate Directly

For many individuals, real estate is the first investment made through home equity. Homeownership is considered direct ownership, where the name on the property’s title is that of the owner/investor.

Enterprising investors can take a ‘do-it-yourself’ approach and purchase second homes or even commercial real estate and self-manage the property outside of one’s primary residence. Strategies such as ‘fix and flip’ abound and would fall under this category.

Some advantages of this approach are that it cuts down management expenses, eliminates performance expenses, and has strong alignment between operator and owner (as they are the same person). In addition, some of these strategies allow making investments in real estate with little to no money. They can also be a good way for beginners in real estate to get their feet wet.

Buy and Hold Public REITs Investments

Public REITs generally own a collection of real estate properties and issue shares trade regularly. These trades happen on public exchanges, and like other common stocks, ticker symbols identify the REIT.

The advantages of REITs are that they allow investors to diversify their real estate ownership and get liquidity by selling the REIT stock over the public exchange. We will discuss REITs in more detail later in this guide.

Invest in Private Equity Real Estate

Investing in real estate assets acquired by a professional real estate manager is a common way to access this asset class. Typically, the manager establishes a fund and sells minority stakes to investors. The fund then acquires single or multiple properties, and as the assets appreciate, the manager and the investors split the profits.

Private equity real estate is regulated more lightly than public investments, and as such, a fair amount of trust should exist between the manager and the investor. Also, access is limited to accredited investors, and minimum investment amounts can be high ($250,000 to $1mm plus).

However, funds can effectively diversify real estate ownership into multiple properties and benefit from a skilled real estate manager with a track record of outperformance. We will discuss investing in private funds in more detail later in this guide.

Invest in Real Estate through Crowdfunding

Crowdfunding is a relatively new investment vehicle that allows multiple investors to pool smaller investment amounts together and then present one more extensive check to a private investment fund manager. Investors who use crowdfunding want access to private equity real estate strategies but have difficulty with the high minimum investment required by these funds.

So, for example, for an investor wanting to invest with a manager who only takes a $250,000 minimum investment, that investor can team up with ten other investors through a crowdfunding platform or website and present one $250,000 investment.

Crowdfunding real estate platforms have been increasing. However, while they can democratize access to traditionally hard-to-access investments, they come attached with significant fees that could impair realized returns.

Having summarized some common ways to invest in real estate, we turn to the characteristics used to evaluate real estate opportunities. Understanding the concepts and vocabulary of real estate investing will allow investors to determine which properties will potentially outperform.

How to Begin Evaluating Real Estate Investments

Given that many factors can influence real estate returns, evaluating real estate investment opportunities can seem daunting. However, once investors internalize a framework to use consistently, the task can get more manageable.

Below, we dive into the common factors that drive real estate returns and values.

Location, Location Location

Real estate is a physical asset where location is a significant driver of value. Two locational characteristics matter – the broader city of the property and the submarket within that city.

Top Tier Cities

Characteristics such as size, economic diversity, and population trends are relevant when investing in real estate. Larger cities (measured by both population size and economic output) are favorable in that they likely have more liquidity (buyers and sellers) than more niche or smaller cities. Cities with economic diversity and not reliant on one or two industries are favorable in that they would be considered more stable and less volatile during downturns. Finally, cities growing and experiencing positive net migration are better than static or declining markets.

Large, diverse markets are also called “Top Tier,” “Gateway,” or “Core” markets.

Bustling Submarkets

Real estate investors also pay close attention to the location of the property within a city. Submarket characteristics include centrality, traffic counts, accessibility, and median income.

For example, centrally located real estate assets with high traffic counts and high median income can command higher rents than properties located in suburban, quieter, and lower-income areas.

Have High Quality Tenants Occupy Real Estate Investmens

The quality of tenants that occupy the property is a crucial characteristic to examine when investing in real estate. Rent payments are akin to interest payments on debt in that tenants should have the financial strength to meet their obligations even if business turns down. Therefore, understanding the tenants’ business should be part of investors’ due diligence when investing in real estate.

One proxy used by real estate participants to judge tenant quality is the tenant’s credit rating. A high credit rating usually means that tenants can continue making rental payments during economic downturns. This characteristic ultimately enhances the value of the property as investors view the stability of cash flows positively.

Occupancy is a Key Driver of Real Estate Investing

Occupancy rate is a crucial statistic to evaluate when making real estate investments. Low occupancy rates mean that the property is not generating the full potential of its profit-making capacity. On the one hand, this is a favorable characteristic because as more tenants occupy vacant space, the real estate asset generates more income for the same general level of investment. However, on the other hand, it can also be a red flag to signal problems with the submarket.

Somewhat counterintuitively, investing in real estate with low occupancy and not ‘paying up’ for future lease signings is a strategy that can work well in real estate investing. If the market is temporarily depressed or new tenants sign on with some repositioning, real estate values can appreciate as occupancy grows.

Further, investing in real estate with full occupancy can be suboptimal because, in a way, it can only get worse. Economic downturns or tenant turnover is inevitable, and in general, investors would be paying ‘full price’ for the asset and then have exposure to the downside if occupancy ticks down.

Structure Landlord-Friendly Leases

Lease terms are fundamental to understand before investing in real estate. While leases can be complex, the following are some critical areas to examine.

Get Attractive Rents

The overall rents and rents versus ‘comparable’ properties (similar in submarket and building type) are vital metrics in property analysis. Low rents relative to comparable properties could signal red flags or represent an opportunity to reset rents at higher levels once the term expires. Conversely, higher rents versus the market would be concerning because the cash flow investors are receiving today would be at risk in the future.

Some lease agreements feature rent escalators and typically adjust upwards with the cost of inflation or a fixed amount each year. In addition, retail properties sometimes have contingent rent clauses, where a percentage of the store’s sales factor into rents.

Sign The Right Lease Length

The length of the lease is another area to pay attention to when investing in real estate. Generally, the lease term is similar across property types (office leases can be 10-15 years and retail leases are 7-10 years). However, when purchasing a property, these leases could have just a few years remaining. Expiring leases can be a positive or negative dynamic for real estate investors, depending on the contractual rent versus market rent and strategy post-investment.

Many times, tenants will have a renewal option or multiple renewal options in their lease contracts. These clauses allow tenants to extend the lease term for a specified period (typically five years) at their option. However, such renewal options can be a risk for landlords if the contractual rent is well below market rents, as that mispricing could persist for a more extended period. It also can hinder the landlord’s potential plan for significant redevelopment or repositioning of the property.

Beware of Capital Investments Liabilities

While the land that real estate sits on can appreciate over time, tenants’ physical building generally depreciates over time. Therefore, replacement capital is usually required to keep the property in its original condition. The level of replacement capital depends on the type of building and the age of the building. For example, a very basic warehouse likely requires little upkeep or refreshment capital compared with a hotel built forty years ago.

Another area for potential capital investment is tenant improvements, or “TI.” TI are enhancements made to the property that is bespoke to the tenant. For example, if a retail tenant or office tenant requires a particular layout to fit their need, preparing that space requires capital. TI is a kind of lease concession made by the property owner to get the lease signed.

Real estate investors should consider the capital investments required when acquiring properties. These investments usually are not factored into typical yield calculations and would lower the anticipated return of a property. In addition, major maintenance items could result in significant capital liabilities and derail an investment thesis. In some cases, such as triple-net leases, contracts are structured to push maintenance expenditures onto the tenant and are favorable arrangements for landlords.

Real Estate Investments Should Use Appropriate Leverage

Real estate investors typically employ leverage when purchasing properties. Several characteristics make lending against real estate assets easier than other types of investments. Long-term contractual leases produce predictable cash flow for owners. The physical building is a hard asset that can be used as collateral if cash flows dry up. And real estate is an ancient asset class with a lot of historical data and underwriting experience.

Given the depth of the real estate lending market, real estate investors typically have a lot of flexibility in determining the amount of leverage they want to employ when making an acquisition. Adding more debt to a transaction lowers the required equity contribution needed to make the purchase and enhances returns on equity if the asset performs well. However, leverage also increases the risk, as any deterioration of the asset value gets absorbed first by equity owners. It also introduces cash obligations that require real estate assets to perform in line with expectations.

There are many metrics used when evaluating leverage levels in real estate investments. For example, loan to value is a widespread metric and measures debt relative to the property’s value, using the transaction value as a proxy for that value. Debt to EBITDA, or Debt to Cash Flow, is another metric that represents total leverage in a transaction and measures debt relative to the actual cash flow generated by the property.

Leverage typically ranges from 20% to 80% loan to value. The appropriate level of debt is subjective and depends on the type of asset, the owner’s investment strategy, the investor’s required risk/return characteristics, interest rates, and general availability of debt.

Supply, Demand, and Cyclicality

Supply, demand, and cyclicality are some of the most important drivers of real estate values. According to basic economic principles, supply and demand set prices. For real estate, rent realization depends on the interest in a particular market for that product and alternative options available for the tenant.

While supply and demand in the long term usually grow at steady rates, markets typically exhibit significant cyclicality in the short term. Demand cyclicality usually comes from macroeconomic developments, the most well-known being the 2008 global financial crisis. Here, the economy entered a recession and companies went bankrupt, and employees got laid off. A mismatch between demand and supply ensued, where real estate vacancy rates increased, and rents declined. However, as the cycle corrected and business recapitalized and began hiring more employees, demand returned, and rents slowly recovered and eventually grew.

Supply cycles are also typical and have substantial impacts on real estate investments. Typically, as rents begin to climb in a particular submarket, it signals that new buildings are needed, and developers see projects becoming economically viable. As a result, rent appreciation can be capped for some time as new properties come online. In some cases, a market can go into a supply cycle where too much supply is brought online in a short period from investor exuberance and can take years to be absorbed.

Supply Constraints Lead to Above-Market Rent Growth

For this reason, investors in real estate focus on supply-constrained locations. These submarkets are perpetually in high demand, but there is simply not enough supply to satisfy that demand. Midtown Manhattan for office, or Bel-Air for residential, are examples. Either there is not physically enough land available, or zoning prohibits additional supply from being added.

Supply-constrained markets are more resilient to cycles and produce more stable and predictable cash flows. They can also grow at faster rates. Signs of supply constraints are areas where the cost of the building is significantly lower than the market value of the building.

Invest in the Right Type of Real Estate

Real estate investments fall into categories according to property type, and understanding the pros and cons of each property type is essential in determining which buildings to consider when making investments.

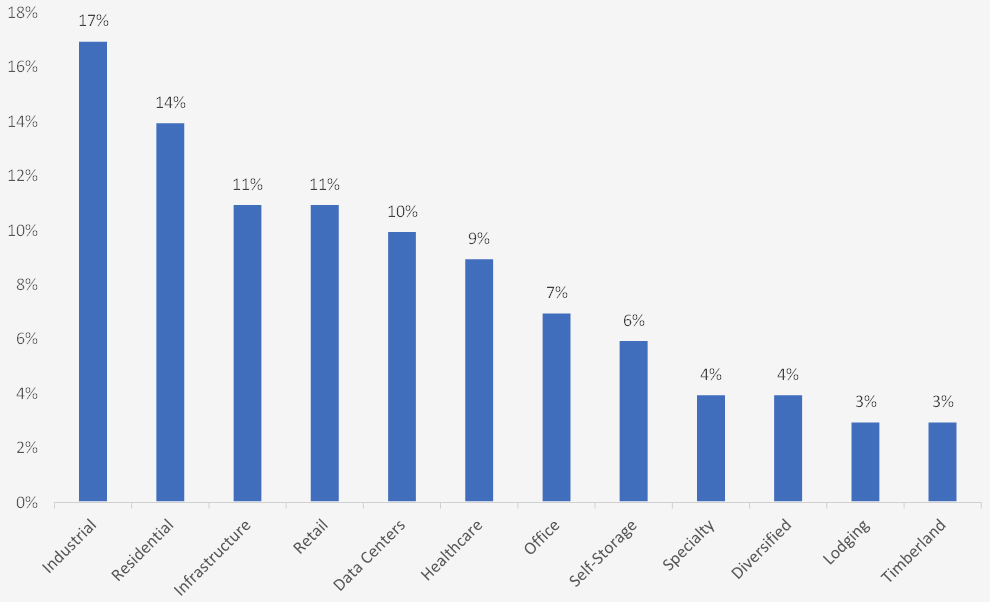

Figure 7 shows the equity market capitalization for different property types in the equity REIT index per NAREIT. This data gives a perspective of how large an investment opportunity each asset class is relative to others.

Figure 7: Equity market capitalization by property type

Residential vs. Commercial

Residential properties are used for living quarters, while businesses conduct activities on commercial properties. Single-family homes and duplex-type structures would fall under residential, while most other properties fall under commercial real estate.

DIY-type investors commonly invest in residential properties because they are easier to understand and more relatable to personal experience. On the other hand, professional investors typically focus on commercial-type properties, potentially involving more complex lease agreements and financing and ownership structures.

Multi-Family Real Estate Investments: Steady Demand

Multi-Family real estate is also known as apartment complexes and has multiple units for living spaces. While not explicitly referred to as multi-family, student-related housing, manufactured homes, and single-family homes are under the broader definition of residential real estate (including multi-family).

Figure 8: Performance of residential equity REITs

Short-term Leases Keep Pace with Market Rents

A unique feature of multi-family real estate is that the leases are short-term in nature. Faster expirations allow owners to increase rental rates when economic activity is picking up as demand typically picks up in this period (the opposite is true during recessions). Frequent rent resetting contrasts with other types of commercial real estate where landlords lock tenants into a lease for 5-10 years, plus.

For investors in real estate concerned with inflation, adjustable rents make multi-family investments attractive as prices can keep pace with general price levels. However, a consequence of shorter-term leases is that vacancy is also more volatile, given tenants can move out after 1-year.

More Active Property Management

Managing multi-family real estate can be more demanding than other types of real estate. New tenant acquisition is a constant concern, and maintenance issues for each unit are ongoing and the landlord’s responsibility. As such, multi-family real estate investments can incur higher general expenses, management expenses, and maintenance outlays.

Stability Through Cycles

Multi-family properties can be more ‘safe’ versus other commercial properties as there would likely always be some level of base demand for living spaces, even during an economic downturn. Market demand for living spaces contrasts with areas used for business purposes as the latter has more of a natural correlation with the macroeconomy.

Net Migration Drives Value

When analyzing multi-family real estate investments, investors are typically keen to understand migration patterns for the city and submarket of the property. For example, properties located in the Sunbelt are benefiting from net migration patterns from coastal areas. Further, there has been a long-term trend within submarkets for migration from suburbs to more urban spaces.

Median household income and trends are also relevant, as gentrifying submarkets could increase rents and affect property valuation.

Homeownership Rates Matter

Homeownership rates are a driver of multi-family demand. Generally, homeownership rates have been cyclical since the early 1990s and bounce between 64% and 70%. For example, homeownership rates fell post the 2008 global financial crisis, given the trauma experienced by homeowners and tighter lending standards implemented. However, persistently low-interest rates and strength in employment caused the number to tick higher post-2016.

A decline in homeownership typically increases the demand for rental units.

Office Real Estate Investments: Levered to the Business Cycle

Businesses utilize office real estate to conduct business activities.

Figure 9: Performance of office equity REITs

Long-Term Leases

In the US, office leases typically last from seven to ten years. While these agreements often have inflation-linked rent escalators, the longer-term nature of such arrangements makes it more difficult for landlords to adjust the rents to market rates. However, real estate investors benefit from the stability and predictability of longer leases, positively affecting property values.

Therefore, examining the lease expiration schedule and noting any significant renewal periods can be a worthwhile exercise before investing in office real estate.

Credit-Worthy Tenants

Real estate investors need to understand the type of tenants that occupy the office property. Typically, higher credit quality tenants are more desirable as they can withstand adverse macro-economic shocks better than smaller businesses and continue paying rent through challenging times.

The tenants’ industry is also an important metric; when acquiring a building with multiple tenants, it is usually better to have multiple tenants in diversified sectors of the economy. That way, if a shock affects one industry over another (for example, the pandemic’s effect on travel), the landlord has some diversification benefit.

Tenant Improvements can Take a Bite

It is customary for landlords to include tenant improvement capital when a new tenant moves into a property. During lease negotiations, parties use TI as a sweetener to get the agreement over the finish line. When supply is tight, and landlords have leverage, tenant improvement packages tend to become less generous. The opposite occurs during periods of office over-supply.

Real estate investors should be mindful of lease expirations and capital costs required to renew or sign new tenants to vacant space.

Central Business District is Best

Generally, office buildings and trophy assets such as skyscrapers command rent premiums relative to suburban office real estate. These spaces tend to rent quicker as there is more demand, resulting in more stability and predictability to rents. Suburban office real estate might come with an attractive yield for investors; however, if a critical lease expires, the building could remain vacant for a long time or require a robust tenant improvement package to lure a new renter.

Macroeconomic Factors Matter

Office real estate has leverage to the macro-economic cycle, and metrics such as economic output and unemployment rates strongly correlate with rents. As a result, real estate investors in office properties should be wary of recession risk or signs of economic slowdowns.

The stability of long-term rents with credit-worthy tenants somewhat balances the risk of recessions on office real estate.

Covid-19 has Changed the Game

The pandemic has introduced novel risks with office real estate—for example, longer-term question marks around employees wanting to work from an office again versus work-from-home. There is also uncertainty around where employees will live and if they will continue to relocate from centrally located residencies to areas with more space.

While it is too early to understand the longer-term implications on office demand in the future, most likely, work-from-home has permanently resulted in the removal of some level of office demand relative to pre-pandemic.

Retail Real Estate Investments: Consumer Spending Dominates

Retail real estate can encompass a variety of property types and include malls, shopping outlets, and strip centers (both grocery-anchored or power centers).

Figure 10: Performance of retail equity REITs

Medium Lease-Terms

Retail tenants typically have shorter lease terms than office and are typically five to seven years in length. Smaller shops would be less than more established retail businesses. Triple net tenants could be significantly longer – ten years plus. In addition, retail tenants generally have renewal option terms in their contracts that could significantly lengthen their lease terms.

Anchor Tenants Drive Traffic

Anchor tenants are those that serve as traffic drivers for the retail center. These could be department stores at malls or grocery stores at strip centers. The traffic generated by anchor tenants benefits all tenants in a particular retail center, and for this reason, real estate investors extend anchors favorable rent deals to occupy their properties.

Shopping Malls are Feeling Pressure

Malls are a common type of retail real estate and can include outlet centers as well. However, the decline of traffic to shopping malls due to online shopping has been a vital investment topic in recent years.

Many Class B and C malls, which are not centrally located or located in more suburban areas, have come under financial distress. As a result, some malls across the US have closed, and those that remain are part of large public REITs or other asset managers.

Look for Prime Locations with Strip Centers

Strip centers are typical shopping centers where stores arrange in rows with a sidewalk front and ample parking spaces. These centers can be grocery-anchored or power-centers (big box retailers 250k to 600k in square feet).

Suburban areas can be of high quality, especially if the surrounding area has a high median household income.

Triple Net Leases are Good for Passive Ownership

Triple-net properties typically have one tenant that leases for 10-years plus and is responsible for all maintenance capital expenditures and property management.

Retailers who own their real estate can create triple-net properties through ‘sale leaseback’ transactions.

Some real estate investors call triple net ‘mailbox money’ because property owners receive predictable income with little to no management duties.

While the store types vary, triple net renters are generally convenience stores, grocery stores, dollar stores, and drug stores. A property owner typically wants to enter into a long-term lease with a very credit-worthy tenant whose retail business is well established and proven.

Online Trendsare Disrupting the Space

Generally, the move of retail sales from physical locations to online has been a substantial headwind to many retail real estate properties. With underlining tenant sales under pressure, rent growth has slowed, and in some cases, can cause entire repositionings of retail properties. As a result, real estate investors engaging in retail properties have to be more selective than in the past and think about what business models and concepts will still have enduring relevance ten years from now.

Industrial Real Estate Investments: Enjoying its Day in the Sun

Industrial real estate properties are warehouse assets strategically placed in localities to optimize the distribution of products between manufacturers and consumers. Besides distribution, storage and manufacturing activities could be industrial use cases as well.

Figure 11: Performance of industrial equity REITs

Triple-Net Lease Terms

Industrial real estate is generally under a triple-net structure and has long-term leases. Lease lengths can be ten years and sometimes 25 years in duration.

Industrial Demand with Secular Growth

GDP growth and industrial activity generally drive demand for industrial real estate. However, currently, the sector is experiencing outsized growth from several positive secular trends in industrial, such as supply-chain realignments and re-shoring, and consumer demand from the development of e-commerce.

Ecommerce Trends Dominate

Ecommerce has had a significant impact on the industrial sector, benefiting properties in several ways. As online purchasing frequency increases, so does the need for more warehoused inventory and moving inventory closer to demand centers. Inventory storage demand has grown with expanding purchasing categories as consumers purchase more types of products online. Online returns are a material demand driver as well.

To put e-commerce’s influence on the sector in perspective, Amazon currently represents approximately 40% of all new industrial leases signed.

Type of Tenants

In addition to Amazon, other significant categories of tenants are manufacturing and transportation businesses. Companies such as Walmart, FedEx, and Target are large tenants of industrial real estate.

Self-Storage Real Estate Investments: Supply Constraints Drive Value

Self-storage property owners manage storage facilities for rent to consumers and businesses.

Figure 12: Performance of self-storage equity REITs

Short Lease Term

Typical leases are month to month, allowing owners to respond to moves in market rents and inflation reasonably quickly.

Favorable Long-Term Trends

Self-storage facilities have enjoyed long-term positive trends, with a growing percentage of the population renting storage space. According to Public Storage, a leading self-storage provider, almost 10% of the population rents storage space. Additionally, younger generations tend to rents space at higher levels and provide a tailwind to growth.

Meaningful Management Duties

Self-storage properties require more active management than other real estate types, particularly in property management and marketing. Therefore, while the industry is very fragmented, some scale is beneficial. For this reason, while the more prominent self-storage players (such as Public Storage and Extra Space) own and operate their storage facilities, they also provide management as a service for non-owned properties.

Supply Constraints are Good for Owners

While supply growth varies by market, zoning requirements imposed by localities can constrain supply growth. For example, these localities can make it difficult to obtain permits to build new storage facilities in response to market demand. In addition, cities can sometimes view storage unfavorably as they seem unsightly in appearance and do not require many employees to run.

As such, rent growth by self-storage owners can be favorable because competitive supply cannot freely enter markets.

Listen to our podcast with Ken Nitzberg, CEO of Devon Self-Storage, a private self-storage real estate firm, for an in-depth perspective on investing in storage real estate.

Other Real Estate Investment Property Types

Investing in real estate can involve property types outside of those mentioned above. Other large traditional categories of property types include hotels and health care facilities. Recently, newer properties have emerged as investment opportunities, such as data centers and cellular towers. There has also been a growing trend to separate operating companies from property companies due to the tax benefits attached to these corporate designations. These ‘OpCo’ and ‘PropCo’ structures have opened up properties such as prisons, casinos, and physical advertising, as real estate investment opportunities.

Next, we will put together all we have learned about the different characteristics and types of real estate through valuation metrics.

How to Figure Out How Much to Pay for Real Estate

There are several metrics that real estate investors use when valuing real estate transactions. Each methodology has benefits as well as drawbacks. There is no silver bullet with any valuation methodology, and it is critical to assemble a mosaic to arrive at a proper understanding of underlying value.

Valuation metrics are also important because they establish a baseline for buyers and sellers of real estate to estimate value and negotiate when putting together a transaction.

Cap Rates are the Most Common Metric For Valuing Real Estate Investments

The most common investment metric used when investing in real estate is the cap rate. Short for “capitalization rate,” this formula is a measurement of yield or income generated off the total value of the real estate investment. The formula is net operating income (NOI) divided by debt plus equity. NOI is calculated by starting with rental revenue and subtracting operating expenses.

While helpful in calculating the total income of an asset, cap rates have several drawbacks. The main disadvantage is that the cap rate implies a consistent yield generated out of the property. Stable passive income might not arise for a variety of reasons, including:

- Vacancy rates change (tenants can leave or new leases are signed)

- Rental rates vary (either the rents are below market and reset higher, or vice versa)

- For maintenance-heavy real estate properties, expenses could change. For example, marketing expenses could decrease for self-storage properties if a property owner starts using digital advertising, which could be cheaper than traditional marketing.

- Capital expenditures are required to sustain the yield generated. For example, for a hotel property, a significant renovation of the rooms are needed to keep pace with other properties coming to a particular market

Another drawback of the cap rate is that it uses the total value for the denominator. Typically, an investment in real estate involves buying either the debt or equity portion of the property. Thus, the cap rate would represent the yield on the combined capital, not the part relevant to the particular investor.

For a debt investor, interest expense over the amount of debt represents return. Likewise, the cash flow available for equity holders over the equity portion of the investment represents a return for the equity holder.

Unlevered Yield to Cost is Better than Cap Rate

Unlevered yield is another metric used to evaluate yield on real estate investments, adjusting for some of the shortcomings of cap rate. The formula is stabilized NOI divided by purchase price plus closing costs plus rehabilitation costs.

[Stabilized NOI] / (Debt + Equity + Closing Costs + Rehab Costs)

Stabilized NOI is a subjective, ‘adjusted’ metric that attempts to use an occupancy rate for a building consistent with a real estate investor’s assumption of actual occupancy at some point soon. It also would adjust for some current rents that the investor believes are unsustainable and substitutes this for a figure representing the investor’s expected rents.

The denominator includes the value of the building and other costs required to take ownership of the real estate and get the property ready to realize the assumed NOI used in the numerator.

Unlevered Yield to Cost attempts to be a more comprehensive representation of the actual yield that a property will generate for a real estate investor if the transaction takes place. Listen to our podcast with Gabe Bodhi, CEO of the private real estate investment firm Tekton Group, for a more in-depth discussion of this metric.

Equity Returns are What Matter for Investments in Real Estate

Equity investors in real estate benefit from the property’s income after paying the debt holders, and any growth realized from the property. Thus, while return on equity, or ROE, is the conceptually relevant metric, its calculation is not uniform.

The dividend yield is the most straightforward equity return metric, representing the amount of cash flow that gets specifically earmarked and paid to equity investors. It is cash flow received divided by the total equity amount.

Cash flow produced after satisfying debt costs, but not officially paid out to equity holders, is also relevant. For example, some real estate investors define cash flow after debt service (including amortization payments). Others might exclude amortization since it could be an increase in equity value.

Finally, real estate investments can sometimes have complex structures and management fees. For a common equity holder in real estate, the most inclusive calculation for understanding equity returns would adjust payments to senior equity holders, such as preferred equity, and remove any management fees paid to real estate sponsors.

Use Net Asset Value for Portfolios of Real Estate Investments

Net Asset Value, or NAV, is a metric used to evaluate a portfolio of real estate investments. While the cap rate of a portfolio is a relevant metric and frequently used by investors, disparate assets can be part of a portfolio, not all of which would generate each asset’s full potential at the time of measurement. NAV is used to adjust for this shortcoming. It appraises each asset in the portfolio separately and then sums the total.

For example, land held in a portfolio that has been undeveloped would theoretically have a value that is not captured in a cap rate calculation since the asset does not generate current income.

Investors can use the NAV of a portfolio and compare it to the amount a seller is willing to part with the portfolio. If the portfolio is trading for a discount to NAV, it can indicate unrealized value for the buyer.

Real Estate Investment Strategies Used to Outperform

When investing in real estate, the investor typically has a strategy to maximize the value of the acquired property. At the right price, purchasing the right asset with the right strategy and efficient execution is key to driving real estate returns. Consistent success here is what establishes a track record for real estate managers.

Some consistent themes of strategies include the following.

Advantaged Deal Sourcing is Key

A methodology of sourcing deals is the first step in establishing a successful real estate investing strategy. The most common way to find investing opportunities would be through brokers or commercial real estate listing sites. Since real estate is typically a deep market with many buyers and sellers, sourcing deals through this method will often be a competitive bidding type process. As a result, the property might clear at a market valuation, and the returns the investment generates should be in-line with similar types of opportunities.

One way to outperform the real estate market is to buy the asset at a favorable valuation. That is, at a price that is lower than the market price. However, this can be difficult given the efficiency in the real estate market and the competitive nature of acquiring properties.

Some ways to be successful here would be to establish deep relationships with brokers in a particular market. Sometimes those brokers will give investors they know an early look at a transaction before the transaction hits the public. Another way would be to know property owners in a locality well so that the investor can make a direct offer to the seller before the property lists through a broker.

Another standard methodology is to focus on a particular niche of the broader market, where there is less competition from other buyers. This strategy can be a deep specialization in complex transactions or a focus on smaller, sub-institutional real estate investments.

Listen to our podcast with Hussain Nathoo of Orangestone Capital, where he discusses how he gets the first look at real estate deals.

What the Ideal Real Estate Investment Looks Like

The ideal real estate asset would be:

- A brand-new property with many amenities

- Located in a supply-constrained submarket in a top city

- Occupied by high-quality tenants that are participating in growing businesses

- Have a lease agreement that is favorable to the landlord

- Generate high rents that are stable and predictable.

This type of property is hard to find and would fetch premium prices. Therefore, most transactions would have variations of these qualities. In an ideal world, each element that deviates from the ideal should carry with it an associated discount to the value of the property.

However, the market is not always efficient, and there is a lot of subjectivity involved in judging all the elements that make up an ideal property. A successful real estate investor would presumably do a better job appraising the aspects than other market participants.

Set Objectives: Income or Growth?

When looking for real estate investment opportunities, it is helpful to have clarity around the goal of the investment. This objective can be boiled down simply to two areas, income and growth.

Income Strategies Dominate

Income-oriented real estate investment strategies must establish the stability and certainty of recurring cash flows. Generally, investors who are looking purely for income want investments with minimal management responsibilities and execution risk. They would also expect to participate in the appreciation of the property over time.

For income-based real estate investments, the riskiness of the cash flows and the potential for property appreciation drives the cap rate that an asset trades. As a result, the best assets will sell for low yields as the properties attract strong demand from investors.

On the flip side, investors who prefer to stretch for higher yields are often sacrificing asset quality. To earn better-risk adjusted returns with higher yield investments, investors need to judge the risks relative to the price paid accurately.

Growth Strategies can Outperform

Growth-oriented real estate investments occur with the expectation that the cash flow an asset generates at the time of purchase will improve after executing a strategy. These strategies can range from simple to very complex.

Since real estate is a physical asset, improving or developing the acquired property would be the most prominent growth strategy. For example, something simple could be a light refreshment of the units in a multi-family apartment complex. Many times a successful real estate strategy involves upgrading fixtures, leading to better rents.

More complex growth development projects would be ground-up development of acquired land or demolishing and repositioning a property. Here the investor has to execute on several fronts, including obtaining the proper permitting, actual construction of the building, and then marketing to tenants to occupy the new property.

Other growth strategies are possible that might not require development or incremental investment. For example, executing a re-permitting strategy for a property not zoned for its highest and best use can lead to gains. Or suppose a retail property is acquired having multiple leases with staggered expiration dates. By negotiating with the tenants or being strategic with signing new leases, an owner could align the terms and then reposition the property.

Types of Real Estate Investment Strategies

Below are some of the most common real estate strategies that combine the different strategic elements discussed above. These are characterizations that help investors in real estate quickly identify and classify the type of real estate investment opportunities presented to them. Investors can then think about the right price for the investment and the types of risks to expect.

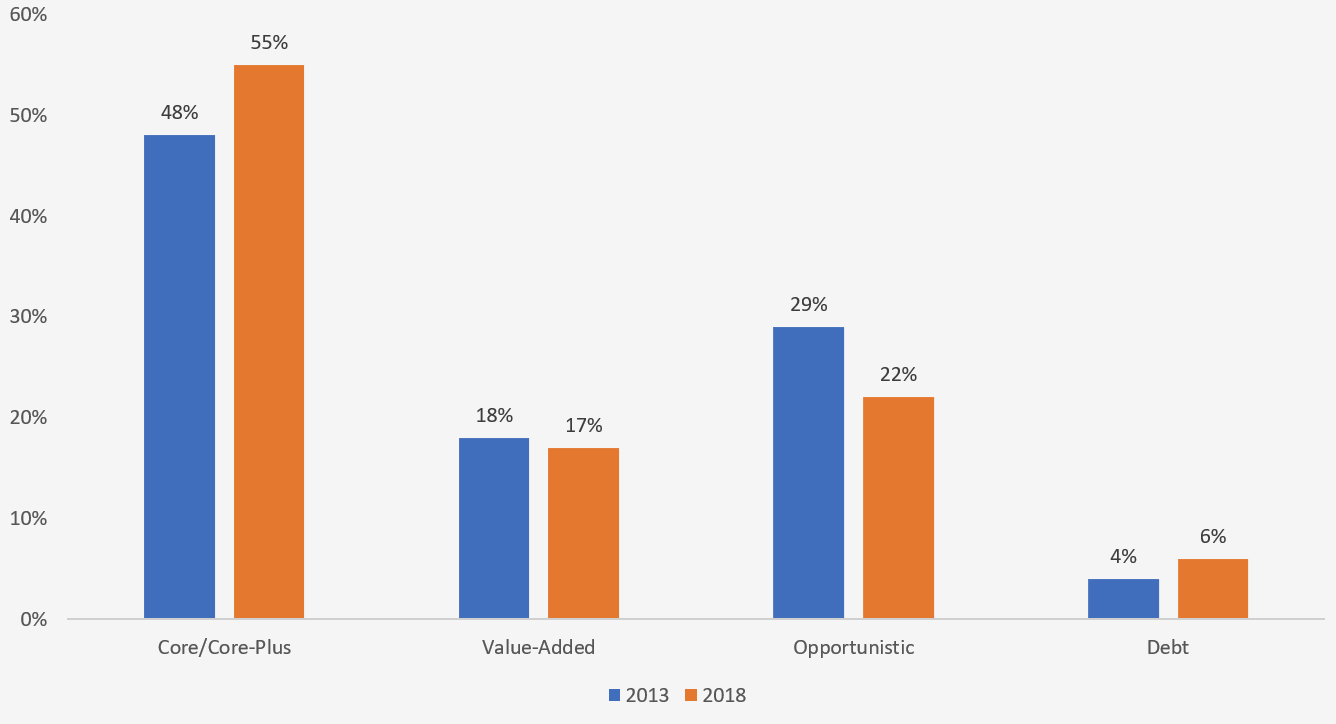

An analysis done by McKinsey & Company illustrated that Core and Core-Plus strategies were the most common strategy used by private investment managers and have increased in popularity over time.

Figure 13: Private real estate gross assets under management contribution by strategy

Core Strategies Generate Stable Passive Income

Real estate investments considered Core properties are generally those located in top-tier cities, in great submarkets, with excellent tenants and lease terms favorable to the owner. These properties enjoy high demand and are usually fully occupied at market-level rents. Typically these strategies target 6-8% annual returns.

Generally, investors in core assets are more institutional-type investors with a low-risk tolerance, looking for an alternative to bonds, and do not expect the investment to appreciate at high rates. Leverage used in core deals is also typically low to be consistent with the low-risk characterization of Core assets.

Because these assets have less execution risk and less of a growth strategy attached to them, fees to access investments through real estate managers should be modest.

Core and Core-Plus strategies represent 55% of gross private real estate assets under management.

Core-Plus Strategies Generate Income with Risks

Core-Plus real estate investments are similar to Core investments in that investors are looking for income and expect the asset would continue to produce steady and predictable cash flow. However, there is usually a compromise that investors make with Core-Plus properties in terms of location or vintage. The leverage used could also be higher than Core properties. Investors expect a higher yield for this compromise than Core investments and typically target 8-10% annual returns.

Core-Plus investments could represent attractive opportunities for investors to earn a higher yield if they understand and adequately adjust for the increased risk. Because these investments might have less institutional demand versus Core properties, investors might find diamonds in the rough. However, the chance that the building becomes vacant and the cost and time to replace a tenant might make up for the higher optical yield.

Because there is more judgment involved in Core-Plus investments, investors could benefit by buying these properties through an experienced investment manager

Value-Add Strategies Have Return Enhancers

Value-added real estate investment strategies are more growth-oriented strategies relative to Core and Core-Plus properties. These properties could have high vacancy rates, expiring leases, or require remolding or repair to earn market rents. The level of debt used in these transactions could also be more aggressive. For the increased risk, investors typically demand higher returns for these investments. Typically Value-Add strategies target 12-16% annual returns.

Because value-add strategies involve a fair amount of execution, investors should consider the management responsibility, time, and expertise required to succeed. In addition, if investors engage in value-add strategies through a real estate manager, there is higher scope for performance-related fees.

Value-add strategies represented 17% of gross private real estate assets under management.

Opportunistic Strategies aim for 16%+ Returns

Opportunistic real estate investments are a catch-all term for various strategies that involve non-traditional approaches. They can be high-risk-high reward situations requiring strong expertise in a particular area, depending on the plan. Typically, Opportunistic strategies target 16%+ annual returns.

Opportunistic strategies could involve land-plays, property repositioning, ground-up development, distressed transactions. The amount of leverage can vary widely.

A highly skilled manager with strong expertise and track record in the relevant areas should be a prerequisite before investing in these strategies. Performance fees for these investments could be high, and the returns realized would be expected to be much higher than Core real estate.

Value-add strategies represented 22% of gross private real estate assets under management.

How to Invest in Real Estate Investment Trusts (REITs)

For investors looking to invest in real estate, REITs can be a very accessible option to get exposure. According to NAREIT, an industry association, REITs collectively own approximately $3.5 trillion of gross assets in the US., with stock exchange-listed REITs owning over $2.5 trillion in assets.

Here we will discuss REITs in more detail and delve into the pros and cons of REITs as real estate investments.

What is a REIT?

A Real Estate Investment Trust is essentially a tax structure that allows the trust to aggregate capital from multiple investors and purchases real estate properties. REITs are pass-through entities and are not subject to taxes as long as they pay 90% of net taxable income as dividends. Thus, the tax system compares favorably with other corporate structures where investors could be subject to ‘double taxation’ at the corporate level and their individual income tax level.

REITs came about in 1960 with the passage of the Real Estate Investment Trust Act. They are subject to tests to qualify them as a REIT, including holding at least 75% of their total assets in real estate, cash, and government securities. They also are subject to the ‘five or fewer’ rule, where five or fewer individuals cannot hold more than 50% of shares. Also, 100 or more persons must be own the equity.

Public REITs are like stocks in that they actively trade on an exchange, can be easily bought through any online brokerage account, and are registered securities with the SEC.

Benefits of Investing in REITs

For invests wanting to get real estate exposure in their portfolios, REITs offer many benefits that make them worth consideration:

Nicely Diversified

REITs typically own a portfolio of assets, and investors in the Real Estate Investment Trust own a minority stake in each property. Minority ownership gives investors the ability to invest in real estate with little money and get diversification benefits. However, suppose the real estate investor wanted a diversified portfolio and tried to assemble one themselves. In that case, the capital commitment could be significant as real estate properties typically are high-dollar investments.

Diversification is a positive attribute because if one property has difficulty requiring major renovation or replacing a tenant, the impact on cash flows gets dampened as other properties would presumably be performing according to expectations.

Liquidity When You Need It

One of the downsides of investing in real estate is that money is inaccessible for extended periods because liquidity generally occurs when the entire property gets sold to another party. These transactions can be a lengthy process and involve significant fees that investors would like to avoid.

Public REITs trade on an exchange and have daily liquidity where the investor’s minority position, or shares held, can be readily sold through a brokerage account. Further, because REIT stocks actively trade, investors know the value of their holdings in real-time. This ability to readily transact contrasts with owning real estate privately, where the investor would have to go through a lengthy and potentially costly appraisal process to get an estimate of the current market value of their holdings.

Professionally Managed with Oversight

Investing in real estate through REITs benefits designating the assets’ management duties to a professional management team. As a result, all aspects of property management are outsourced, including managing tenants, selling assets, and recycling capital into new investments.

The REIT management team is also subject to oversight from a Board of Directors. Shareholders elect these individuals to steward and monitor the management teams to represent shareholder interests fully.

Conservative Leverage Profiles

REITs generally employ more conservative debt levels when making investments into real estate assets and benefit from better loan terms than smaller, single-asset real estate owners. As a result, having favorable access to debt can be a crucial driver of outperformance.

Currently, equity REITs have a 28% debt to capital ratio, versus typically 50%+ for private real estate.

Attractive Dividends

REITs must pay out 90% of their taxable income as dividends to qualify as a REIT. As a result, REITs generally pay higher yields than the overall stock market and can be a good option for investors looking for passive income.

Currently, equity REITs have a 2.79% dividend yield versus 1.24% for the S&P 500.

Strong Performance

Outside of dividends, investors would ideally want to invest in real estate where returns keep pace or exceed those in the broader market. As we have seen by examining the historical performance data, REITs have outperformed the S&P500 over long periods.

Drawbacks of Investing in REITs

While investing in Real Estate Investment Trusts can be an excellent solution for many investors, there are several drawbacks to consider:

Management and Shareholder Alignment Can Be Missing

Managers of REITs are professionals and generally have a long history of success in the industry. Boards also choose them to lead companies after besting plenty of competition for the top job. However, ultimately incentives drive behavior, and there is usually an incentive for managers to put their interests ahead of shareholders.

The generous compensation arrangements that managers of REITs enjoy (packages can approach or exceed $10 million per year) can incentivize them to trade shareholder performance for their job longevity. Unfortunately, this dynamic can cause management teams to be overly conservative when evaluating opportunities in the shareholders’ best interest.

Compensation also implicitly or explicitly ties to the number of buildings or the total amount of capital managed. As a result, this arrangement can incentivize management teams to grow the overall size of the REIT by engaging in aggressive acquisitions. However, numerous academic studies have shown that share price performance suffers when management teams engage in M&A.

Management Overhead Can Impair Returns

Investors in REITs are also incurring substantial expenses to maintain corporate overhead that supports the company’s professional management. These can be significant expenses into lavish corporate offices, trips on corporate jets, and spending on travel and entertainment. These expenses can eat into the income generated from the underlying real estate and lower the return available to shareholders.

Lack of Opportunistic Strategies

REITs generally engage in low-risk strategies to produce consistent, steady income with modest capital appreciation over time. In addition, they have highly diversified portfolios, usually own Core assets, and employ modest leverage. While these are all positive factors, for investors looking for more substantial returns and can withstand the risk that comes attached, REITs might not be the most efficient investment opportunity.

As we’ve discussed previously, there are value-add and opportunistic real estate strategies that can generate solid returns if coupled with experienced managers. These managers can exploit inefficiencies in niche markets that do not attract institutional capital. They can also employ aggressive leverage to enhance returns.

How to Invest in Private Equity Real Estate

Investing in real estate through private funds, also known as ‘private equity real estate,’ is another popular method for investors to gain exposure to real estate in their portfolios. Private equity real estate falls under the category of alternative investments, which is an asset class dominated by institutional ownership. In a recent survey by Cornell University, approximately 70% of the real estate held by institutions was through private real estate funds.

However, non-institutional investors are increasingly gravitating towards alternative investments. Below we discuss essential areas to consider when making real estate investments through private funds.

What is a Private Equity Real Estate?

Private equity real estate investments are investment vehicles where multiple investors can pool their capital to invest in properties managed by a professional third-party or “sponsor.” Such investments can take place in many forms, either through a fund with multiple properties or on a deal-by-deal basis for individual properties. In addition, structures can be closed-ended or open-ended.

Private investments are exempt from registering with the SEC under the Securities Act of 1933 and Investment Company Act of 1940.

Prevalent structures involve a General Partner (or “GP”) and a Limited Partner (or “LP”). The GP is the sponsor who originates the transaction, puts the deal together, executes the strategy, and controls the entity. The LP is typically the minority investor who participates in the opportunity and would have voting rights but generally cedes control and investing discretion to the GP.

Once the investment liquidates, the GP and LP split the returns per the original operating agreement. Again, this division favors GPs as they take an outsized portion of the profits from performance fee compensation.

Because these investments have light regulation, have a lot of flexibility around structuring, and include performance-related fees for the sponsors, it is worth having a solid understanding of the pros and cons of investing in real estate through private funds.

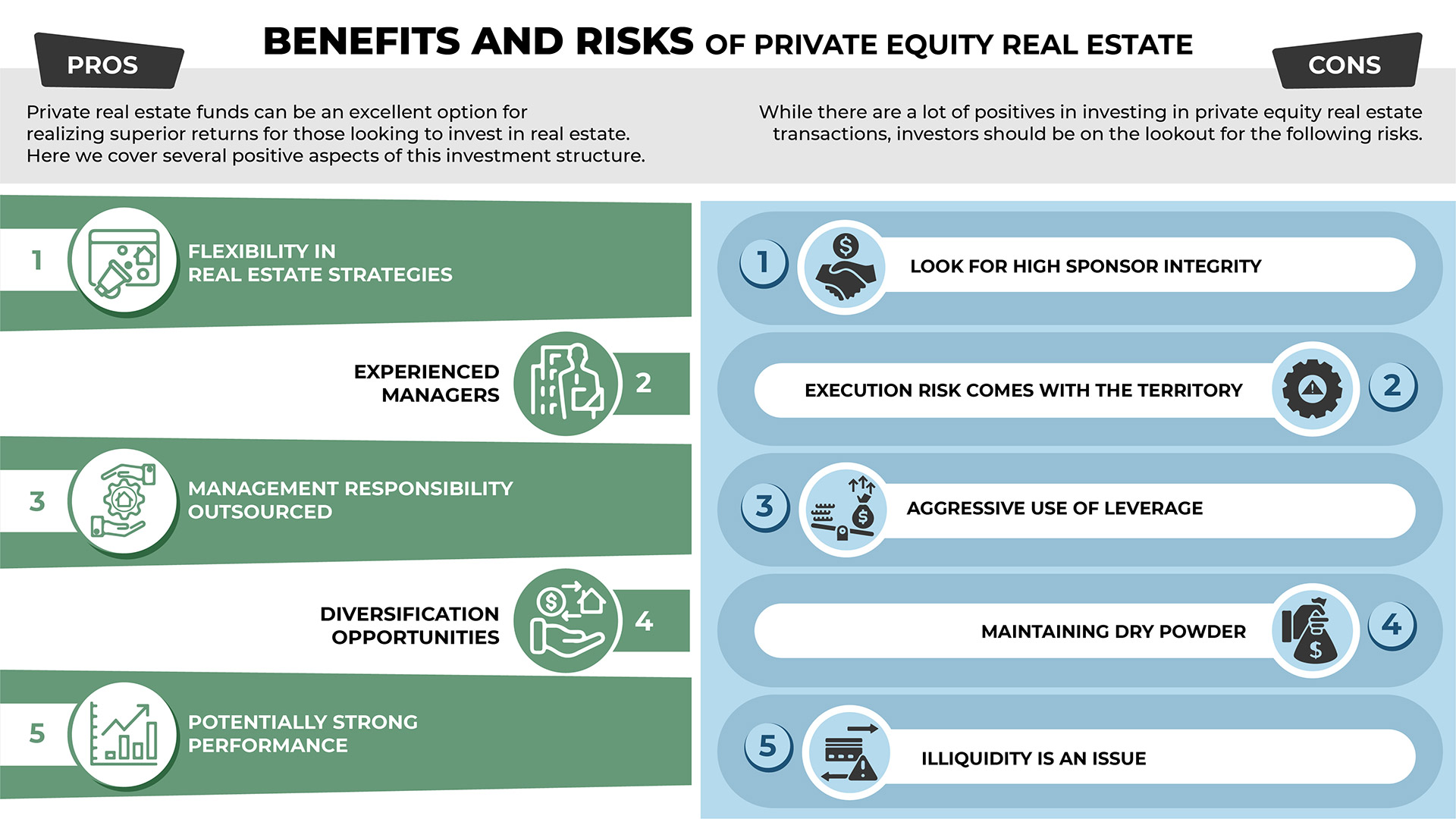

Benefits of Investing in Private Equity Real Estate

Private real estate funds can be an excellent option for realizing superior returns for those looking to invest in real estate. Here we cover several positive aspects of this investment structure.

Flexibility in Real Estate Strategies

Private real estate funds can be very flexible in their mandates and objectives. They can often implement opportunistic strategies that allow them to pursue investments outside of typical income-based approaches. Core-Plus, Value-add, and Opportunistic strategies have more of a growth component and more robust returns.

Experienced Managers

By investing in private real estate funds, investors can access extremely talented sponsors with solid track records. Over the years, these sponsors could have developed expertise in particular niches they regularly exploit to deliver strong performance. Investing alongside these managers allows investors to participate in the upside along with the sponsor.

Management Responsibility Outsourced

Investing through a sponsor in a private deal allows investors to have an experienced manager manage the day-to-day responsibility of operating the property.

Diversification Opportunities

Those wanting to invest in private equity real estate can invest through funds with multiple real estate holdings. These funds allow investors to hold ownership stakes in numerous properties and achieve diversification benefits with little money.

Potentially Strong Performance

Private real estate funds can achieve superior returns over ordinary income-based real estate approaches. This alpha can come from the flexibility of their strategy, experienced managers, and investing in underserved markets.

Risks of Investing in Private Equity Real Estate

While there are a lot of positives in investing in private equity real estate transactions, investors should be on the lookout for the following risks.

Look for High Sponsor Integrity

Private equity real estate is lightly regulated and has a lot of flexibility around how the agreements are structured. As a result, sponsors typically have discretion over investing investor funds and have substantial control over the assets they acquire. This dynamic means the investor must have a high degree of trust with the sponsor before investing with them.

Shady practices such as paying hefty management fees to themselves, or procuring products and services from entities they control, are a few areas where sponsors can take advantage of investors.

Execution Risk Comes with the Territory

Given that sponsors might pursue opportunistic strategies to maximize returns, sometimes that involves executing effectively. For example, a sponsor might have a great plan to acquire a vacant office building in a Class C location to reposition the building into a self-storage facility and then sell the land for use as retail. However, executing the plan can involve significant risk at each step.

Investors should be mindful of these risks and have confidence in the sponsor’s ability to execute their stated strategy successfully.

Aggressive Use of Leverage

Typically, private equity real estate fund managers employ more aggressive and active approaches to investing in real estate. Sponsors usually have a fleshed-out execution plan and have strong oversight and day-to-day management of the asset. As a result, it is not uncommon to see 60-70%, sometimes more, leverage used in these transactions.

While leverage can enhance returns, it can also magnify risk. As a result, some academics estimate returns from private equity real estate funds should be adjusted downwards by 200bps to account for increased leverage risk.

Listen to our podcast with Commercial Brokers International, a real estate firm, for a more detailed discussion of how real estate managers think about leverage,

Maintaining Dry Powder

When investors invest in private equity real estate funds, the capital is usually not required at the time of the original commitment. Instead, it is typically ‘called’ when the sponsor identifies a property and needs the fund to execute the transaction. For this reason, investors need to have liquid assets to satisfy capital calls.

There is an opportunity cost of maintaining liquid assets that is a drawback of private funds. An academic paper in the Journal of Portfolio Management estimated 100-200bps of opportunity cost annually for this dynamic.

Illiquidity is an Issue

Private real estate investments are typically illiquid. As a result, transaction costs are high, and the time it takes to find a buyer can be lengthy.