Why should you care to invest in Private Equity? Because Private Equity (“PE”) investments have the potential to notably increase the returns of your portfolio. Here are some compelling statistics:

- From 2000 to 2014, private equity investments have generated an average 15.4% IRR versus the contemporaneous S&P 500 average IRR of 12.6%. They’ve bested the S&P’s performance in every single year.

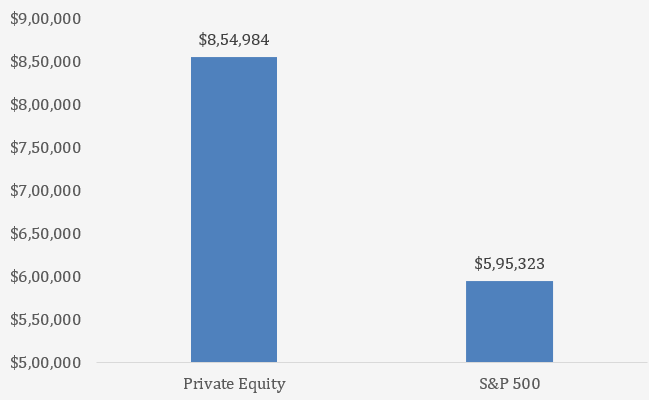

- A hypothetical $100,000 investment in private equity in 2000 would have grown to $854,984 by 2014. That return compares to $595,323 for the S&P 500, or 44% higher (see below for a more detailed explanation of these calculations).

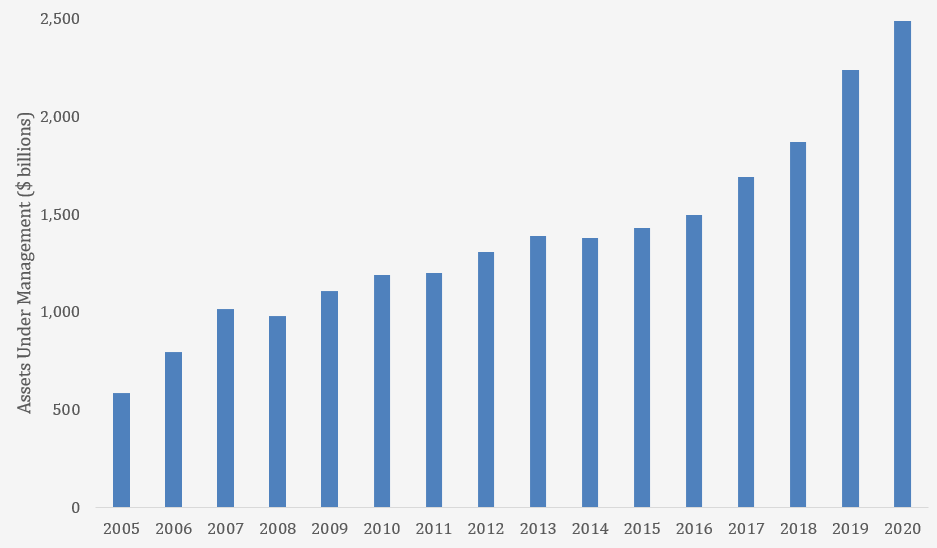

- These returns have caught the eye of large, professional, institutional investors and those with the highest wealth. According to Preqin, total private equity assets under management have grown from $586 billion in 2005 to $2.5 trillion today.

- Endowments and ultra-high-net-worth investors have ~50% of their portfolios allocated to alternative investments such as private equity, versus ~5% for the mass affluent.

For non-professional investors, investing in private equity, however, comes with some roadblocks. Unlike creating an online brokerage account and buying the S&P 500 index, investing in private equity funds typically needs the help of a skilled investment manager.

However, once you’ve selected a proper manager, investing in private equity could be well worth the added effort.

In this guide, we will cover the most critical aspects to understand to invest in private equity. By the end, you should understand how private equity managers can beat the market, the risks involved in these investments, and how to access these managers and strategies.

Estimated reading time: 26 minutes

Table of contents

- How to Define Private Equity?

- Strong Performance of Private Equity Investments

- How Private Equity Investments Generate Strong Returns

- Risks Associated with Private Equity Investments

- Private Equity versus Publicly Traded Stocks

- How Private Equity Firms Work

- How to Make Investments in Private Equity

- Conclusion

- Frequently Asked Questions

How to Define Private Equity?

Private equity represents a type of financing where a firm invests capital or money into a business operating in a traditional field (such as restaurants, retail stores, healthcare, etc.) in exchange for an ownership stake. Below are some essential facts:

- Private equity is an “alternative investment” and groups with similar investments, such as venture capital, real estate, and hedge funds.

- A private equity firm invests in businesses with the idea of increasing the company’s value and ultimately selling the business at a profit.

- Similar in scope to venture capital firms, private equity firms use the capital provided by investors, or limited partners (LPs), to invest in private businesses that hold a future promise for growth.

- Unlike a venture capital firm, a private equity firm often holds a controlling stake (50% plus) when investing in companies. Control allows private equity managers to direct the company to make significant changes in its strategy or operations.

Strong Performance of Private Equity Investments

Is private equity investment worth it? Private equity has enjoyed a strong historical performance, with an average IRR of 15.4% from 2000-2014. This performance has bested public stocks, represented by the S&P 500, in every period.

Figure 1: Private Equity IRR (by vintage year) versus contemporaneous S&P 500 IRR

Source: Robert S. Harris, Tim Jenkinson, Stephen N. Kaplan, Ruediger Stucke, “Has Persistence Persisted in Private Equity? Evidence from Buyout and Venture Capital Funds.” November 2020.

Link to the academic article here.

Underlying Data Source: Burgiss

It is essential to note the challenges inherent in calculating private equity returns. Because private equity investments are illiquid and return capital at different times, IRR is a standard metric used to measure performance. IRR accounts for these irregularities in cash flows.

However, there are shortcomings to this approach, as the IRR calculation is extremely sensitive to the time capital is returned and assumes that cash flows are re-invested at returns that might not be realistic.

Multiple Invested Capital (MOIC) is commonly used and measures the ratio between total capital returned to an investor versus the original investment.

A significant drawback to this approach is that it does not adjust for the length of time an investment takes to return the capital. For example, there could be a significant performance difference between returning money to an investor in year one versus year ten.

A method gaining more acceptance from the investor and academic community is the public market equivalents (PME). PME standardizes the IRR into an equivalent public market return. It assumes that cash flows realized from private investments are re-invested using an index of public stocks (such as the S&P 500).

Using the PME methodology, a hypothetical $100,000 investment into private equity in 2000 would have grown to $854,984 by 2014, versus $595,323 for the S&P 500, which is 44% higher (see figure 2).

Figure 2: Future Value of a Hypothetical $100,000 investment in 2000 into Private Equity versus the S&P 500 by 2014

Source: Calculation by PitchBoard using the IRR data in Figure 1

It is no surprise that superior performance has caused the private equity asset class to grow strongly (see figure 3). According to the publication Institutional Investor, endowments and ultra-high-net-worth investors have ~50% of their portfolios allocated to alternative investments such as private equity, versus ~5% for the mass affluent.

Figure 3: Private Equity (Buyout) Assets Under Management

Source: Preqin

So how do PE funds generate such attractive returns? Let’s understand some of their methods below

How Private Equity Investments Generate Strong Returns

The unique methods available to PE managers make private equity investments worth considering.

Using Debt to Increase Returns

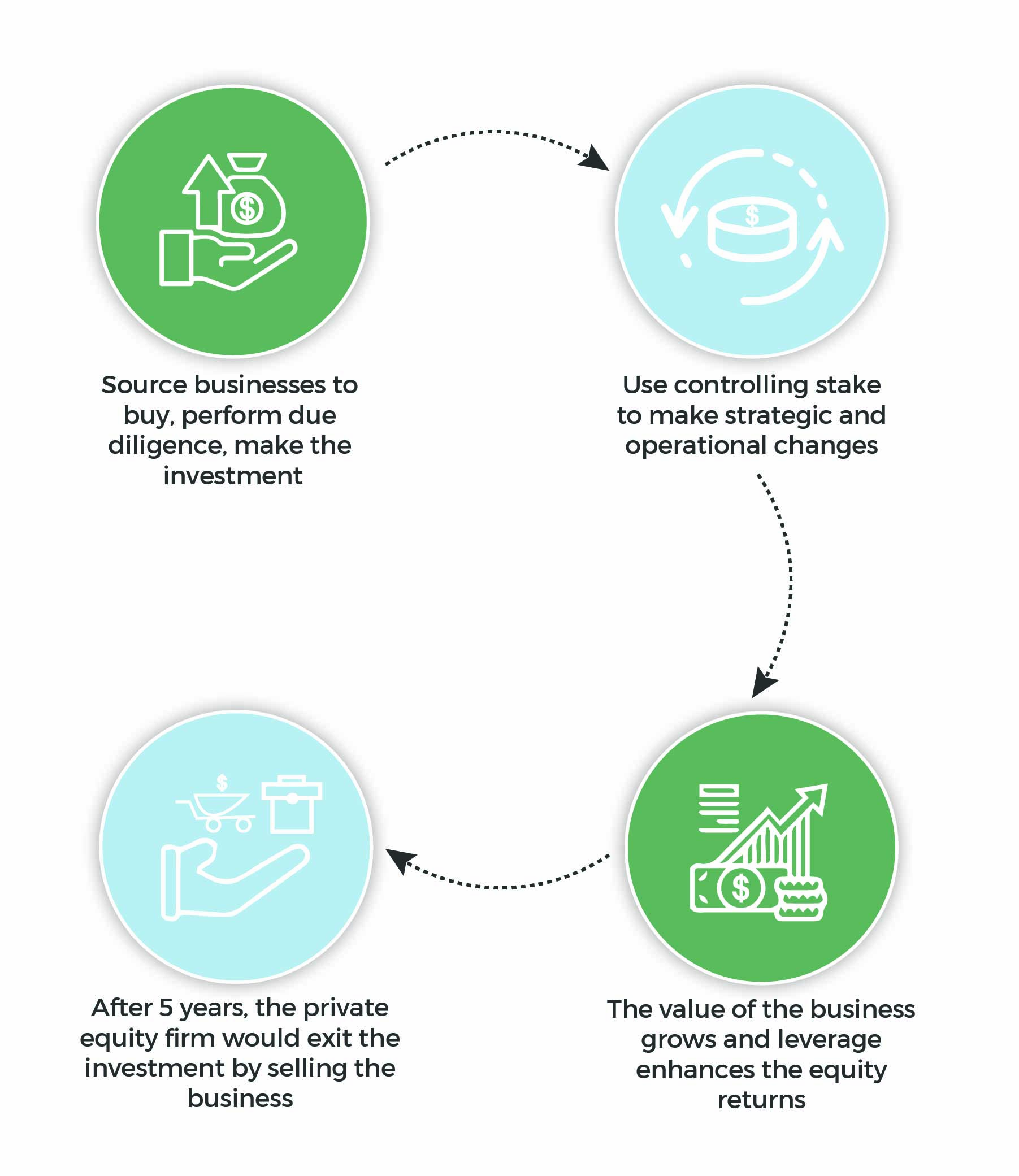

Leveraged Buyouts (“LBOs”) are the most common way private equity firms generate strong returns. LBOs involve ‘optimizing’ the capital structure of an acquired business for the benefit of its owners.

Firms aggressively use debt to increase the equity returns generated by private equity investors. One of the landmark examples of the LBO was KKR’s acquisition of RJR Nabisco for $25 billion in 1988. At that time, it was the largest buyout in history.

Private equity strategies that mainly rely on debt to increase equity returns are becoming rarer today as the method is no longer unique. LBOs have also come under criticism for creating unstable businesses vulnerable to bankruptcy in an economic downturn.

Taking Advantage of Full Control

Today, private equity firms are turning to more creative methods that some argue are more ‘healthy’ or sustainable.

For example, by holding 100% of a firm’s equity and sitting on its board of directors, private equity managers can control critical business decisions. These decisions include accelerating a company’s growth pace, either internally or by the use of capital.

If a private equity firm has strong expertise in the business’ industry and a network of experienced partners, it can take on self-help projects to improve operations. These include simplifying a company’s cost structure, reducing complexities, or exploring undiscovered markets or white spaces.

Private equity firms can also utilize capital to grow. Often, they can help a company get financing from the financial sector, private lenders, or follow-on investments from their committed funds. With capital, PE funds can build new facilities or expand to new geographies.

Platform Businesses When Investing in Private Equity

A popular and potentially effective private equity strategy involves:

- Purchasing an initial, or “platform,” business, usually operating in an industry considered appealing with excellent growth potential.

- Perform a series of “bolt-on” acquisitions, all backed by financing secured through its lending connections or follow-on investments from its fund, to grow the size of the business swiftly.

- Extract ‘synergies’ by merging several firms and eliminating unnecessary operations and back-office functions.

- Appoint operating partners to vital executive roles to maximize execution of objectives.

The goal is for the PE fund to increase its profitability by year five when it will be more significant, more stable, and a leader in its field and sell for a premium valuation.

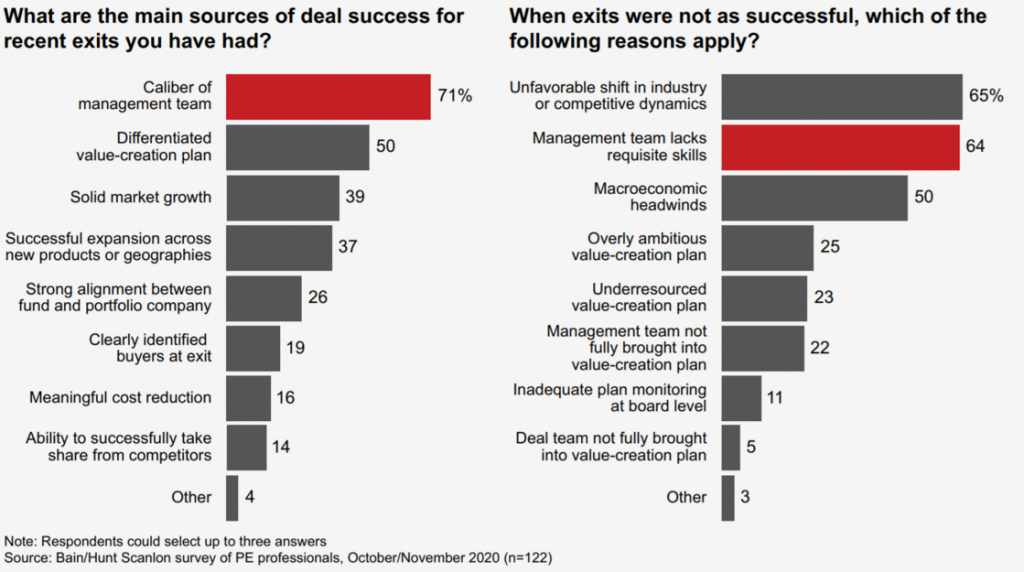

A recent survey from a leading private equity manager (Bain & Company) of 122 private equity professionals is below. It highlights the importance that management teams play in the success or failure of a deal.

Of course, things do not always go to plan, and it is crucial to understand the potential pitfalls of this approach, which we cover next.

Risks Associated with Private Equity Investments

While investing in private equity funds can be very rewarding, there are areas where these investments can run into trouble.

- The most well-known of these dangers is for a private equity fund’s investment to face solvency issues and ultimately declare bankruptcy. While debt can boost profits when a firm is growing, its overuse can have the opposite effect.

- Private equity-backed businesses are also vulnerable to broad-based economic downturns, such as the financial crisis in 2008 or the COVID-pandemic in 2020. The fact that a company is private does not afford it special protection from a recession.

- Another risk of PE investing is overpaying for an acquisition. When a PE firm misidentifies a growth opportunity available to the business, it could pay too much for the deal. If these growth opportunities do not materialize, the investment can generate disappointing returns.

- Secular challenges to a business’ industry, or an overly aggressive competitor, can negatively affect the returns of a private equity firm’s investment as well. For example, if a private equity firm invests in a newspaper business at the wrong time, it may lose to online print sources or fall victim to new media innovations.

Are you trying to put all of this together? A helpful way to appreciate the unique parts of PE investments is to compare them with public stocks, which we do below.

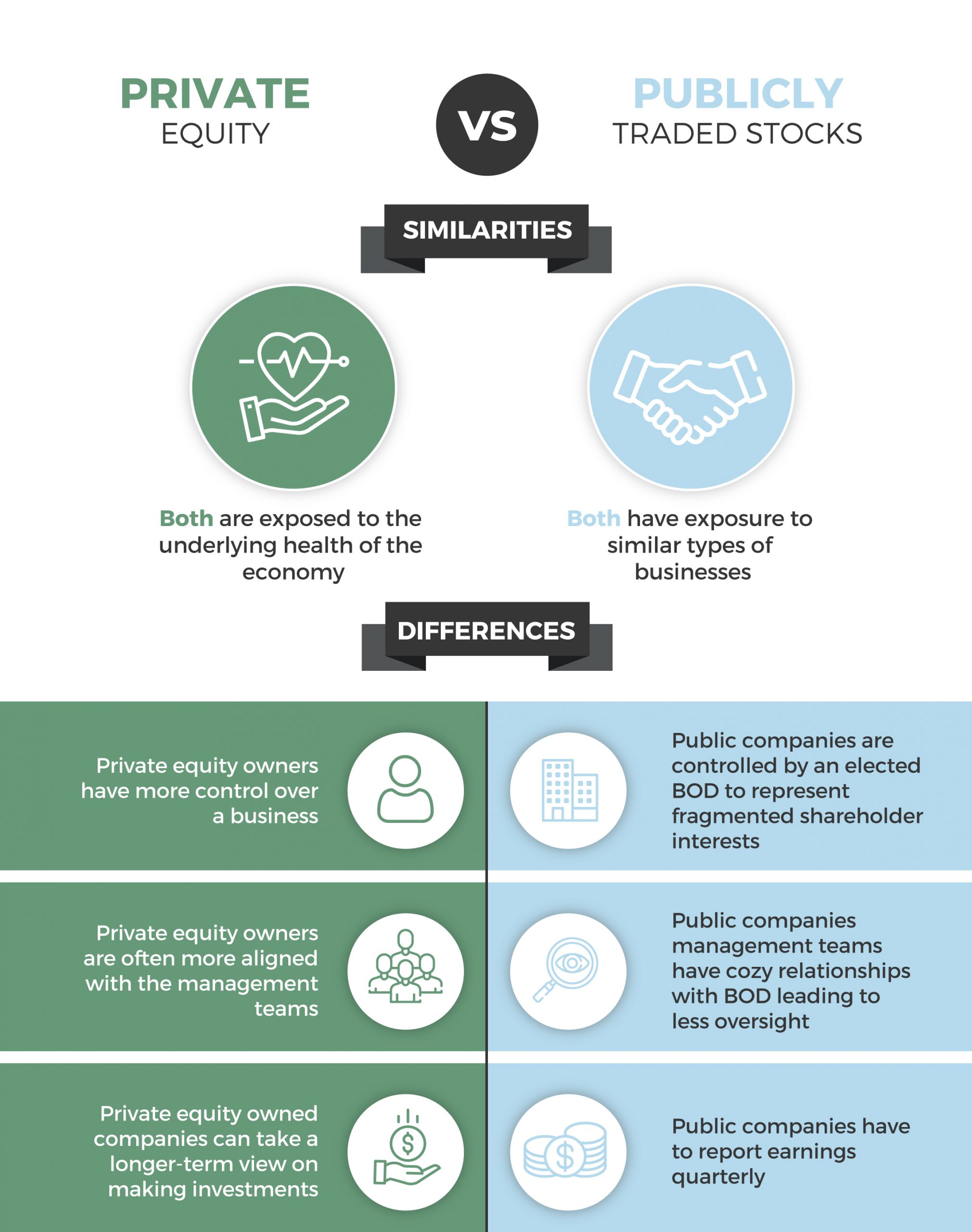

Private Equity versus Publicly Traded Stocks

An investor can buy ownership stakes in private businesses by investing in private equity through a manager or can purchase ownership stakes in public companies by investing through individual stocks, mutual funds, and ETFs.

Similarities between Investing in Private Equity and Public Stocks

- Generally, businesses are pro-cyclical. Thus, as the economy grows, the profitability of a business grows as well. This factor affects both private and public equity ownership stakes.

- Most industries that private equity firms buy (such as industrial companies, technology enterprises, or consumer-oriented businesses) have public-equity counterparts.

- Large PE firms may take public companies private or seek to exit their investment by selling their stakes through an initial public offering (IPO).

Differences between Investing in Private Equity and Public Stocks

- Private equity firms buy controlling stakes in the businesses they invest in, often paying a premium to acquire this control.

- A controlling stake enables owners and managers to have closer alignment, which may not exist in publicly traded companies.

- The management itself often selects the board of directors in a publicly-traded company, leading to poor oversight.

- PE firms do not have to report quarterly financial results to the public. Less frequent reporting allows companies to have a longer-term focus when making decisions.

- Private equity investments aggressively use leverage because the risk tolerance of the investor base is high. On the other hand, publicly traded companies operate with less debt, as investors are typically more averse to risk.

- Investments held in PE-backed businesses are more illiquid than publicly traded stocks, which are exchangeable for cash during market hours. By comparison, the liquidity for a private entity only happens when the entire business is sold, with a typical 5-year holding period.

Now that we’ve learned why it’s worth investing in private equity let’s dive into the areas private equity funds can excel in, creating superior value and differentiating themselves.

How Private Equity Firms Work

Here we dive a little deeper into the most critical areas that private equity companies focus on to generate strong returns.

Where Private Equity Firms Find Deals

The way private equity firms find acquisition prospects is where outperformance opportunities begin. Private equity managers can either use brokered auction systems or ‘proprietary’ strategies to discover businesses to buy.

Brokered Auctions to Invest in Private Equity

Here, the broker (typically an investment bank) will run an auction process (similar to selling a home) by marketing the business to private equity firms with a history of purchasing similar companies. The broker will assemble an information memorandum describing the company and investment opportunity.

Private equity firms then begin an extensive due diligence process and put together detailed financial models that will allow them to calculate their maximum bid to hit the desired return profile. Once the offers are in, the highest bids typically win at auction.

While auction processes represent an efficient way to source and execute deals, their competitive nature and ‘highest-price wins’ process sometimes make it difficult for firms to outperform.

Proprietary Methods to Invest in Private Equity

Private equity firms will talk about ‘proprietary’ methods to source deals to find off-market opportunities. These are deals without a broker that do not go through an auction process. The lack of competition can allow PE firms to get a better value on the initial investment.

This process is a more complex way to source PE investments but can be fruitful if firms have a strong network or reputation in a specific industry. It also allows firms to be proactive and move fast if they hear a business is up for sale.

Hear directly from private equity managers about how they approach sourcing deals through our article here.

How Private Equity Firms Perform Research

Having a thorough vetting process is another way private equity firms can outperform.

PE funds do extensive research on businesses before investing. Ultimately, PE firms create ‘an investment thesis’ to summarize their views. This investment thesis involves examining all aspects of a company, including its financial metrics, customer relationships, product details, expenses, accounting audits, and legal exposures.

Private equity firms also want to understand market opportunities that can catalyze growth after the acquisition and the financing arrangements available to them from lenders. Therefore, the due diligence process involves several people outside the firm’s initial deal team.

These individuals may include management consultants, auditing consultants, lawyers, investment bankers, operating partners, and industry experts. The entire due diligence process can be costly, especially if a firm loses a bid at the end of a deal process.

Why Companies Allow Private Equity Firms to Acquire Them

Understanding why a privately-owned business would want to sell to a private equity firm is key to defining how PE funds can create value.

A company may decide to sell itself to a private equity bidder for a variety of reasons. For example, a business may have reached a point where its entrepreneurial management style impedes growth, and a more professional approach is required.

‘Professional’ here may reference:

- Management style

- Relationship network

- Scaling growth processes

- Leveraging technologies

Business owners may also reach a stage in their career (i.e., age, wealth, health) where they want to step back from the daily responsibilities of management.

Occasionally, strategically merging with another company in the same sector (becoming a “platform” business) may stimulate growth and synergies. Finally, changes in the business’ value (whether favorable or unfavorable) may prompt management to sell for cash.

How Private Equity Firms Exit Their Investments

PE funds always have an exit plan whenever they invest, as the value realized from a sale is a crucial driver of performance.

Typically, at the end of a typical 5-year hold period, private equity managers seek to exit their investments to create liquidity for their investors. These exits typically happen by:

- Sale to another private equity buyer;

- Sale to a strategic buyer;

- Going public via an initial public offering (IPO);

- Performing a dividend recapitalization; or

- Liquidity through a SPAC structure.

Sale to Another Private Equity Buyer

When the PE firm implements its strategies for growth, it may seek to sell to another buyer. Selling allows the private equity firm to recycle its investment and maximize value for its investors.

The purchasing private equity firm may have a different set of capabilities and prove to be a better business owner at this stage.

Some of these capabilities include having relevant operating partners, infrastructure to take a company to the next level, or investors with a different (lower) return expectation than the first private equity firm.

Sale to a Strategic Buyer

A buyer that operates in the same industry as the business owned by the private firm is called a ‘strategic buyer.’

Strategic buyers can typically pay the highest price because they can achieve the post-deal synergies. Cost synergies are cost savings from eliminating duplicate overhead and infrastructure. Revenue synergies are those from a better-combined product or service.

Additionally, strategic buyers can obtain financing efficiently by using the collateral in their existing firm to make an attractive purchase offer.

Going public via an initial public offering (IPO)

An IPO through a stock listing is another frequently used exit approach, as public investors sometimes can value a business higher than private buyers might offer.

Some characteristics that public investors appreciate include superior growth, a well-known brand name or CEO, and an attractive investment story. As a result, stock prices in such instances can escalate to extremely high levels from investor exuberance.

However, fees may quickly accumulate when a private equity company engages an investment bank to underwrite the offering or employs a legion of attorneys to guarantee compliance with SEC registration requirements.

Public companies also have strict financial and accounting disclosure requirements. These disclosures of economic performance and profitability become open to customers and competitors to scrutinize.

Finally, private equity firms typically will sell only a part of their stake during the IPO, and lock-up provisions may probit them from exiting quickly.

Performing a Dividend Recapitalization

A recapitalization involves private equity funds taking cash out of a company and paying themselves through a special dividend.

Depending on how much the business grew between the initial investment and the time a special dividend, managers may be able to pull out the entire initial investment as cash and still retain ownership.

Liquidity Through a SPAC Structure

A variation of the IPO strategy, one increasingly used today, is a Special Purpose Acquisition Company (“SPAC”) structure.

While these can be complex transactions, generally, a firm will put together a SPAC vehicle (which is funded by public equity) and then look for an acquisition candidate. These candidates can be public or private companies.

If the SPAC identifies a company, it will acquire a stake or the entire business using the capital raised before making the offer.

How Private Equity Firms Finance Their Investments

One of the fundamental challenges in PE investing is obtaining financing to buy an entire business. These types of transactions are usually large and complex and often require multiple parties.

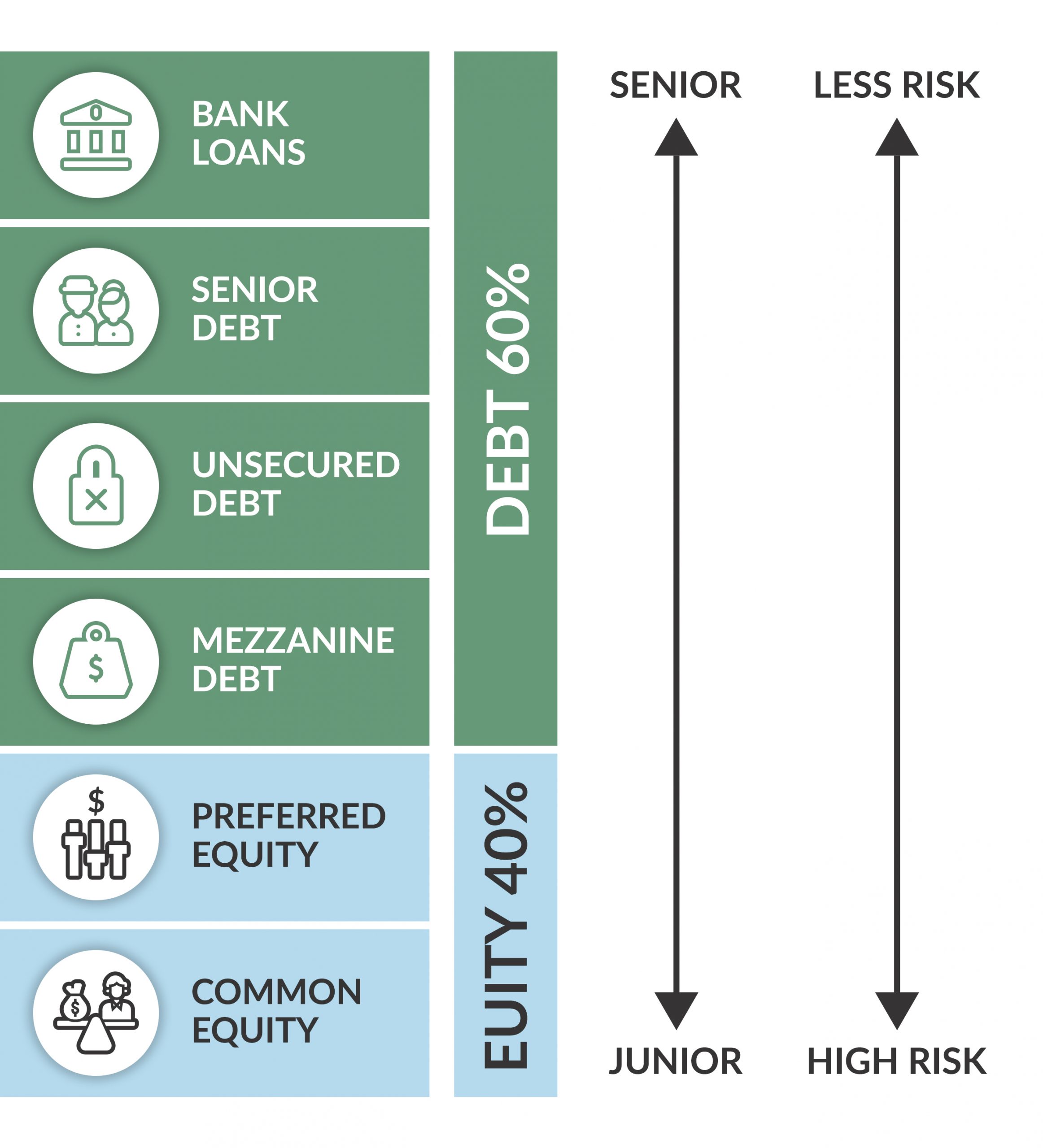

At the most basic level, a private equity firm will employ equity (its investment) and debt (from lenders) to finance its deals. However, in reality, there are many layers to each of these pieces of capital. These layers come with unique terms and conditions, investors, and return expectations.

The following points provide the basic ideas behind structuring a PE investment.

General Structure

The capital structure in private equity financings arranges from most senior to least senior elements. During bankruptcy, the more senior parts get repaid first and thus are considered relatively ‘safe.’

Collateral is direct claims on a business’s assets. Loan agreements generally incorporate collateral in the most senior components of the financing.

While safety can be welcome, it does come with downsides. For example, increased security from seniority and claims on collateral generally reduces realized returns. Senior investors usually also get a fixed return and do not participate if the business turns out to experience growth.

Debt Financing

The credit side of the equation might include (in order of seniority) bank loans, senior notes, unsecured notes, and mezzanine loans.

Bank debt is generally the most secure item in the capital structure, as it has a fixed rate of return earned over a published index (such as LIBOR). The investors in bank debt are large banks. These loans are generally highly secured and collateralized by a business’s assets.

Senior notes are also considered very safe. Large institutions (i.e., pension funds or insurance companies) invest in notes instead of banks. These institutions can afford to lock up their capital for extended periods. As a result, instruments typically contain no-call periods of five years or more.

Unsecured notes are comparable to secured notes but may be called ‘junior debt,’ or ‘high yield’ or ‘junk debt’ by investors. This type of senior debt has less security/collateral attached but has a higher interest rate to compensate for the increased risk.

Mezzanine financing is a broad term that refers to various financing structures, typically with a quasi-debt and quasi-equity return profile. Therefore, the financing may include equity warrants to enhance its return profile or paid-in-kind (PIK) features.

Equity Financing

The equity component bears the most significant risk in bankruptcy as it recovers its investment last. However, it also has the most potential for gains. The most salient features of the equity items are preferred equity, common equity, and warrants/options.

Preferred equity is more senior and generally includes a ‘liquidity preference.’ Liquidity preference allows for more leeway in recouping the investment in the event of a bankruptcy or sale for a lower than anticipated price.

However, the equity may have a fixed, debt-like rate of return, limiting its upside potential.

Common equity is often at the bottom of the capital structure and will recover little if any, value in the case of a bankruptcy. However, common equity generally benefits the most should the business grow.

Finally, warrants and options exist to give preferred economics or incentives to particular parties of the investment. Usually, management teams receive these instruments as part of their performance-linked compensation.

Now that we have a thorough understanding of the meaning of private equity firms, let’s review how to make actual investments in these opportunities.

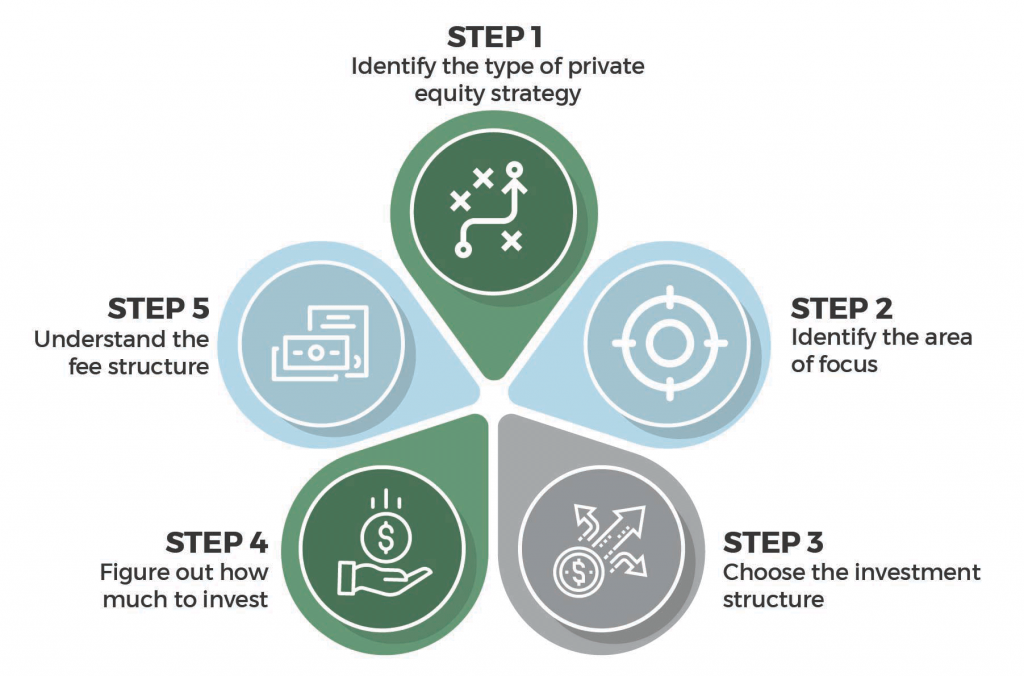

How to Make Investments in Private Equity

Step 1: Identify the Type of Private Equity Strategy

At its most basic level, private equity represents a strategy in which a company acquires control of a functioning business. The economy’s performance, the performance of the industry in which the business operates, and the strength of the business’s underlying growth determine success.

The risks include an economic downturn, the instability of excess debt, or the intrinsic business risks in the company.

However, private equity also has distinct areas of emphasis that expose investors to slightly different risk-and-return profiles than those mentioned above. These types of private equity investments include:

Venture Capital

Venture capital and private equity funds both acquire ownership in private businesses. However, venture capital invests in early-stage companies that have not yet reached maturity.

Additionally, their stake may not be significant enough to exert control over management. Instead, venture firms typically own in the range of 10% of the business and can advise managers.

As a result, the return profile may be significantly better than private equity if an early-stage firm achieves significant growth. But, the likelihood of failure may be greater too.

Debt is less of a feature here since early-stage firms have less leverage due to their less-stable cash flows or use of hard assets. Venture capital is distinct from private equity in terms of risks and returns to the point of being considered a different asset class.

Growth Equity

Growth equity is a type of PE investment in businesses larger than start-ups but smaller than established enterprises. These businesses need help growing and seek partners to assist in professionalizing their operations or bringing capital to invest.

Growth equity managers may share ownership and control with the current management team, restricting their influence on the organization. Additionally, growth equity firms usually employ less debt than larger firms.

Leveraged Buyouts

LBOs are the most common type of private equity strategy.

These can be big transactions with giant private equity companies acquiring significant and well-known businesses. An example of a large buyout is Apollo Global Management and TPG Capital’s 2006 acquisition of Harrah’s Entertainment for $27.8 billion. KKR, Blackstone, Warburg Pincus are examples of prominent PE funds investing in very large LBOs.

PE managers can perform LBOs on smaller transactions focused on a market niche as well.

Step 2: Identify the Area of Focus

Within the strategies of private equity discussed above, PE companies occupy various niches, aiming to operate in less competitive markets. These niches are critical for private equity managers to generate outsized profits for their investors.

Lower-Middle Market

One of the most common areas of focus is the size of the business that a private equity firm purchases. Private equity managers may operate in the ‘lower-middle market’ – a strategy where they look for companies that might be too small for larger private equity firms and thus find better deals.

We interviewed a very insightful lower-middle market manager, and he discussed this approach in our podcast here.

Combining a favorable purchase price, developing these businesses rapidly, and a premium sale price may significantly enhance the returns. Further, a lower-middle market focus serves as excellent private equity investments for small investors.

Industry Specialization

Another niche is industry specialization. Increasingly, private equity managers are becoming hyper-focused on specific industries where they have strong expertise and deep industry connections.

These PE funds might have a unique outlook for how a particular industry is evolving and a vision for how successful businesses should look. Private equity managers can focus on particular niches and outperform, making these investments worth considering.

Step 3: Choose the Investment Structure: Independent Sponsors versus Committed Funds

Two types of investment structures common in the private equity industry are: independent sponsors and committed (commingled) funds.

Independent Sponsors

Independent sponsors generally do not have committed funds and, instead, have networked relationships with investors. These firms initially identify investment opportunities and then seek financing to fund their purchases on a deal-by-deal basis.

Investors benefit because they retain discretion and freedom to choose which investments to make. They also avoid the investment timing uncertainty of when ‘capital calls’ are made. Finally, the fee arrangements for these investments could be friendlier than committed funds.

Committed Funds

Investors in these funds have ceded choice over acquisition targets to the private equity managers. As a result, when the PE manager issues a capital call, investors must finance their commitments, regardless of their views of the merits of a particular deal.

These funds are also known as ‘commingled’ vehicles because it includes an investor’s capital with other investors in the same pool. The advantage of this structure is that it is more hands-off for the investor. Once they have built confidence in the private equity fund, they can spend less time completing their due diligence on each deal.

Generally, independent sponsors seek to establish a track record by executing successful transactions on a deal-by-deal basis before striving to raise a fully committed fund. However, some independent sponsors are content never to raise committed capital.

Step 4: How Much Money Do You Need to Become a Private Equity Investor?

The amount an investor can allocate towards private equity can vary dramatically, depending on their circumstances.

How Can You Become a Private Equity Investor?

Only accredited investors (broadly with a net worth of at least $1 million) are legally allowed to invest in private equity.

As investors’ wealth increases, they may commit a more significant proportion of their portfolio to private equity. However, an important consideration is the lack of liquidity featured by PE investments due to long investment horizons (i.e., five years or more). Therefore, investors should have the ability to meet their daily financial commitments without having to access their PE investments.

Private equity investment arrangements typically require a ‘capital call.’ Capital calls occur when a private equity firm identifies and executes a deal, then calls on investors to fund their original commitment to the fund. Therefore, investors must be sure to have access to the promised committed amount at the time of the capital call.

Minimum Private Equity Investment Amounts

Investment minimums for private equity can be high but vary greatly depending on the size of the fund. Other factors driving minimums include how well-known or established the fund is, the strategy employed, and the relationship with the investor.

It is not uncommon to have minimum PE investments in the $1 million range, with a net worth in the neighborhood of $20 million to $30 million. (Assumes an investor devotes 10% of their portfolio to private equity and wishes to work with a few private equity firms).

However, minimum PE investments as low as $250,000 do exist and may operate extremely lucrative niche models, lowering the necessary net worth below $10 million.

These arrangements can serve as private equity investments for small investors.

Step 5: Understand the Fee Structure

Becoming a successful investor in private equity funds requires a firm understanding of the various fees involved.

Private Equity managers typically employ variations of the classic “2 and 20” fee structure inherent in alternative investments. The “2 and 20” means a 2% management fee on the fund’s total capital due each year. And another payment of 20% on the returns generated (sometimes calculated over an established ‘hurdle rate’ of approximately 8%).

As competition for capital increases in the space, variations of this fee structure are becoming increasingly evident. Other fees to be aware of include:

- Management fees

- Other fund-level fees

- Access fees (brokers, fund of funds)

PE Fund Fees to Invest in Private Equity

The management fee pays for ongoing operations of the firm, such as salaries for employees, due diligence fees paid to consultants, acquisition search fees, travel, and entertainment.

Other fund fees, such as organizational expenses, operational costs, accounting, and legal fees, and fund administration costs, are generally charged in addition to management fees. The fees can vary based on the size of the private equity fund (a small percentage for big funds or a larger percentage for smaller funds).

When private equity firms report performance to investors, regulatory guidelines require representing both ‘gross’ and ‘net’ fees. These reporting requirements help PE investors understand how complex fee arrangements affected the returns coming to them.

Access Fees to Invest in Private Equity

Additionally, investors should be aware of costs paid by brokers, investment advisors, or fund of funds structures to connect investors with managers.

Often, investors require assistance in identifying managers. They may also seek help from advisors or platforms that execute investment transactions. These middle-men can charge either transaction fees (typically between 1% and 4% of the money raised) or management fees (around 1%annually).

Due to the opaque nature of the alternative investment industry, these layers of fees can accumulate and degrade an investor’s return profile. As a result, investors use personal ties and referrals from friends to access alternative investments such as private equity.

Conclusion

Given that private equity investments can outperform public stocks, these investments deserve more attention from investors.

Private equity funds generate returns by using debt to buy businesses and using their controlling stake to accelerate their growth rate. PE firms are vulnerable to economic downturns and overly aggressive use of leverage.

Choosing the right manager is of critical importance. We’ve outlined areas where managers can differentiate themselves and attack attractive market niches. These niches can include a lower-middle market focus or an industry specialization.

Frequently Asked Questions

While you can buy stocks through an online broker, getting access to private equity investments generally requires investing through an investment manager. The extra effort, though, is worth it as private equity investment can significantly outperform public stocks.

Private equity is an investment into a privately held business. Private equity firms generally buy a controlling stake in operating businesses (such as restaurants, retail stores, healthcare companies, etc.).

PE funds finance the purchase by using a combination of debt from lenders and equity from their investors. They then make strategic and operating improvements to the business to increase its value and sell the company after approximately five years for a higher valuation

The minimum investment required to make a private equity investment varies by the investment manager. Generally, only accredited investors (who have $1 million or more net worth) can make private equity investments.